Crypto Tax Software

a cryptocurrency tax calculator that has been designed to help individuals and businesses calculate their taxes accurately, with a user-friendly interface. The platform supports over 300 cryptocurrency exchanges and wallets.

Koinly Review And Best Alternatives

If you want to calculate your taxes yourself, it takes a very long time! And a lot of calculations. Thankfully, there are software nowadays that does all that for you!

One of them is Koinly. In this Koinly review, we’ll explain all about Koinly, and we’ll answer the urgent question: Is Koinly the best crypto tax calculator? We’ll know in this Koinly review.

Also Read: 15 Best Crypto Tax Softwares & Calculators in 2023.

About Koinly.

Koinly is where you can add your transactions. Koinly will fetch market rates, match transfers between your own wallets, and generate your capital gains and income tax reports. All that was done in less than 20 minutes!

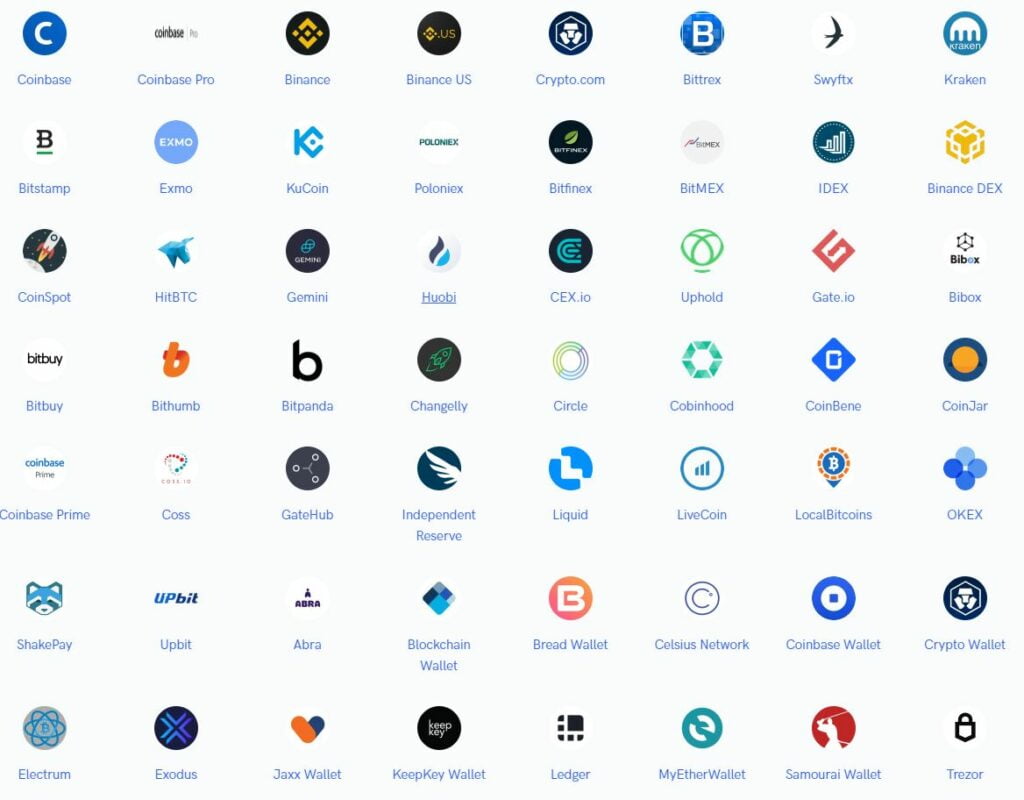

Koinly is a cryptocurrency tax calculator that has been designed to help individuals and businesses calculate their taxes accurately, with a user-friendly interface. The platform supports over 300 cryptocurrency exchanges and wallets, making it very easy for users to import their transaction data from different sources.

One of the most impressive features of Koinly is its ability to track and calculate taxes for different types of cryptocurrency transactions such as trading, mining, staking, and lending. This makes it easy for users to keep track of their tax obligations, even if they have multiple sources of income from different cryptocurrency activities.

In addition to its tax calculation features, Koinly also offers a range of other tools such as portfolio tracking, transaction history, and capital gains reports. These tools are designed to help users keep track of their overall cryptocurrency investments and make informed decisions about their portfolios.

Koinly’s accuracy depends on what you feed to them, as there will be no error on their side. However, the platform has been praised by users for its accuracy and ease of use. The platform’s customer support is also top-notch, with a dedicated team available to help users with any questions or issues they may encounter while using the platform.

Overall, Koinly is an excellent tool for anyone looking to manage their cryptocurrency investments and tax obligations. Its user-friendly interface, accurate tax calculation features, and range of additional tools make it a standout platform in the cryptocurrency space.

Koinly Features

Portfolio Tracking.

Trendy feature across all cryptocurrency platforms. You’ll easily know all about your holdings in all your wallets, Actual ROI and invested fiat, Income overview, and Profit/loss & capital gains.

In addition, you’ll know your tax liabilities. Very useful features ease a lot and save time in only a single look.

Data Import.

Safely import data from your wallets into Koinly. That way no need to keep moving back and forth from one wallet to another. Sync your wallet data to Koinly to get a full view of your wallets and all your trading activity with the help of many features like:

Automated data import: Connect your wallets through API keys, and Koinly will automatically import data and start processing them for you all on your click.

Smart transfer matching: If you transferred assets between your own wallets. Koinly is smart. It’ll know that and won’t treat them as trades.

Reliable Tax Reports.

You can view your capital gains and taxes and generate documents when you want.

Also, Koinly supports a lot of tax reports, and it is available in 20 countries, including the USA, Canada, the UK, Germany, and Sweden.

In addition, you can export your transactions to other tax software like TurboTax, TaxAct, and H&R.

Error Reconciliation.

No more inaccurate tax reports! With many tools, Koinly allows you to find any problem with your transactions.

Double-entry ledger system: Every change in your asset balances is backed by an entry, making it easy to debug issues.

Missing transactions: If there was an error in the data you provided to Koinly or even a missing transaction. Koinly’s AI will highlight that for you.

Auto import verification: You don’t need to worry if everything is correct or not. Koinly will check the wallets you linked through the API key to make sure that all data imported are correct.

Duplicate handling: Koinly will skip duplicates, even if your data was imported through an API key or CSV file. That way, you don’t need to keep track of what’s new and what’s not. Just upload it all!

Supported Cryptocurrencies and exchanges.

Koinly supports every cryptocurrency listed on CoinMarketCap and every single Ethereum token. And whenever a new cryptocurrency joins the exchanges, it’s automatically added to Koinly.

Also, Koinly supports a generous amount of exchanges(over 350). You’ll definitely find your exchange there.

FAQ.

Is Koinly Easy to Use?

Yes, it is with a very simple, responsive, and user-friendly interface. You’ll find it very easy to use Koinly and generate tax reports.

How Secure Is Koinly?

Asking about Koinly’s security is fundamental due to the nature of the business; that’s why your data is imported securely, as they have a very strong security system.

Your payment details are never stored; in addition, you’re connected through API keys, and you can view and edit permissions.

Which Countries Does Koinly Calculate Taxes For?

Koinly supports taxes for most countries; here’s a list:

USA, Canada, Australia, New Zealand, UK, Germany, Sweden, Denmark, Finland,, Norway, Netherlands, France, Spain, Italy, Austria, Lichtenstein, Ireland, Czech Republic, Estonia, Malta, Japan, South Korea, Singapore

Also, any country that supports one of the following accountancy methods:

First In First Out (FIFO), Last In First Out (LIFO), Highest Cost, Lowest Cost, Average, Cost Basis, Shared Pool

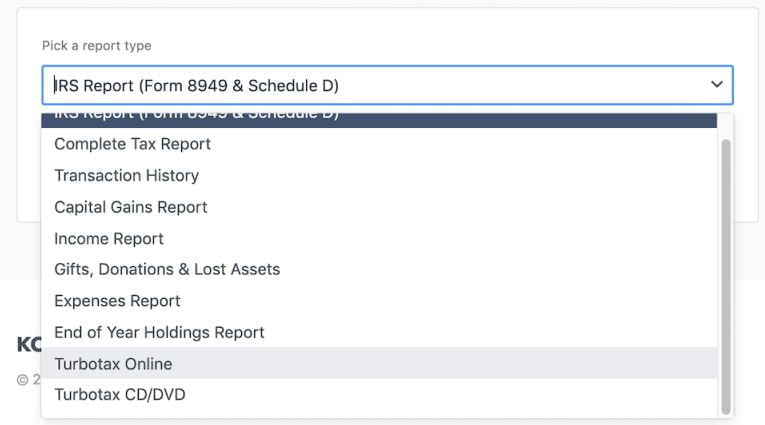

What Tax Reports Does Koinly Support?

Luckily, Koinly generates and supports a big list of tax report types; they also localize tax reports for your country.

And here’s a list of some localized popular tax reports supported by Koinly:

Form 8949 and Schedule D…

Capital gains summary for the UK.

K4, Rf1159, Swiss Valuation Report, Sheet 9A

Not only that, But also a list of standard tax reports such as:

Complete Tax Reports, Transaction Reports, Capital Gains Reports, Income Report, Gifts, Donations & Lost Asset Reports, Expense Reports, End of Year Holdings Reports, Turbotax Reports

How does Pricing work on Koinly?

Koinly offers various pricing plans (starting from $49 to $179) designed for different user levels: Newbie, Hodler, and Trader (Pro), alongside a free option. The free plan has a transaction cap of 10,000 and limited tax report coverage. Transaction limits play a crucial role – for instance, if you had 7,000 transactions in 2019, you’d need the Pro plan for accurate reporting, and for 100 transactions in 2020, the Newbie plan suffices. Choosing the right plan depends on transaction volume to ensure accurate tax reporting.

Get Started on Koinly.

In addition to all the features we explained in this Koinly review, Getting started on Coinly adds up to them; considering how easy it is, It will take you only a few minutes.

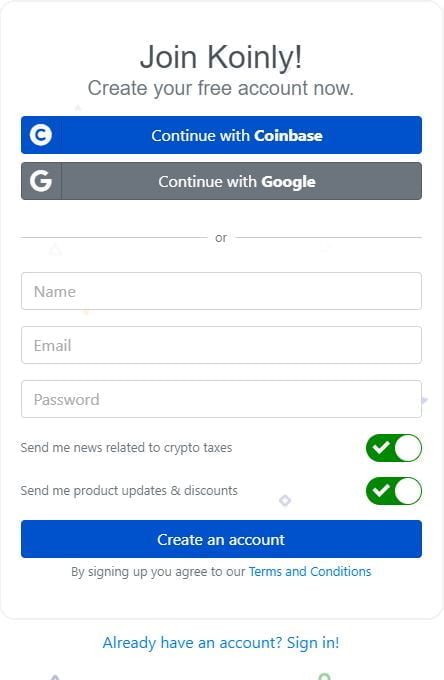

Create an Account.

Firstly, Go to the Koinly Sign up page; enter your information—name, Email, and password.

Verify Your Email.

After submitting your information, go to your email to verify your account using the email they sent you.

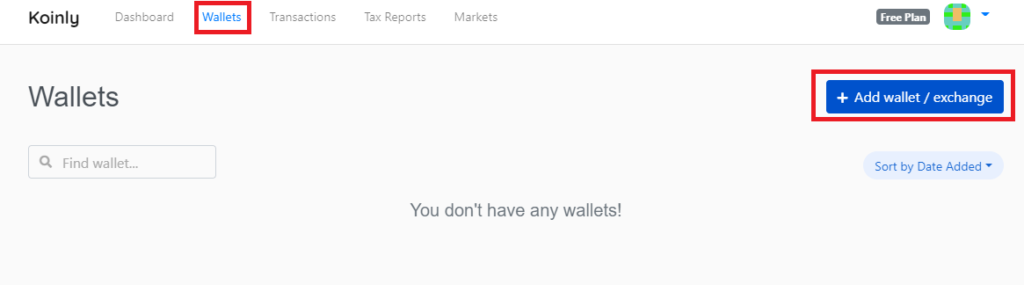

Connect Your Exchange And Import Data.

Firstly, Go to the ‘Wallets’ page on Koinly and click on ‘Add Wallet’.

Secondly, choose the exchange you want to connect with. Have you noticed how many exchanges they support yet?

Connect your exchanges through API, add your wallet address, and Koinly will automatically import data and start.

Generate a Tax Report.

In order to generate a tax report. Firstly, go to the ‘Tax report’ page, and you’ll see a brief summary of your capital gains and income for any tax year.

Secondly, scroll to the bottom and download one of the tax reports. – very easy and simple.

Conclusion.

To sum things up, After a mouthful review for Koinly. Here’s what Koinly’s review got us to think about, sorted as pros and cons as usual.

Pros.

- Very easy and simple to use.

- A lot of supported tax reports.

- Localized tax reports for your country.

- You can pay with crypto.

Cons.

- Plans can be confusing.