DeFi, NFT, & crypto taxes done in minutes

Built by expert industry veterans in technology, finance, and accounting, ZenLedger allows you to easily import crypto transactions, calculate gains and income, and prepare your tax returns.

ZenLedger Review And Best Alternatives

It’s still a pain to calculate taxes. But, in this ZenLedger review, we will explain how you can automate your tax calculation.

If you’re an active or casual trader, you must calculate your taxes at the end of each tax year. Yes, it’s yearly. However, it takes a lot of time to go over all your transactions.

Crypto tax calculators make life much easier; with only a few clicks, you can import all your transactions, calculate your taxes, and generate your taxes forms. Yet, we’ll illustrate how to start with ZenLedger as one of the best crypto tax calculators.

About ZenLedger.

Built by expert industry veterans in technology, finance, and accounting. Therefore, ZenLedger allows you to easily import crypto transactions, calculate gains and income, and prepare your tax returns. Cryptocurrency investors control their portfolios, generate profit-loss statements, file taxes, and avoid IRS audits using ZenLedger.

Also Read: Best Crypto Tax Softwares & Calculators.

ZenLedger Features

During our ZenLedger review, its various features motivated us to speak in detail about them. In the following, we’re explaining each of ZenLedger’s features.

Crypto Tax-Loss Harvesting Tool.

ZenLedger’s tax-loss harvesting tool automatically analyzes your transactions. Accordingly, it displays a list of saving opportunities to take advantage of.

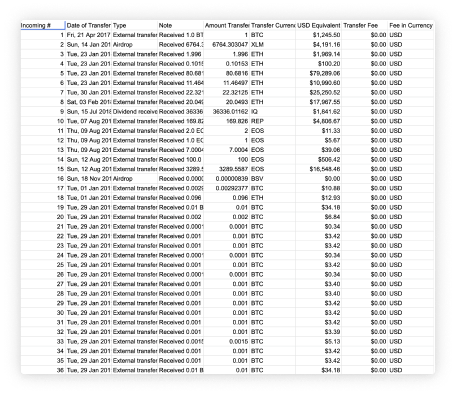

Grand Unified Accounting

In one sheet, you can view all your transactions across all connected wallets. Also, you’ll see calculated taxes for each of them.

TurboTax Direct Integration.

ZenLedger integrates with ZenLedger. Hence, you can import your taxes into TurboTax for further processing.

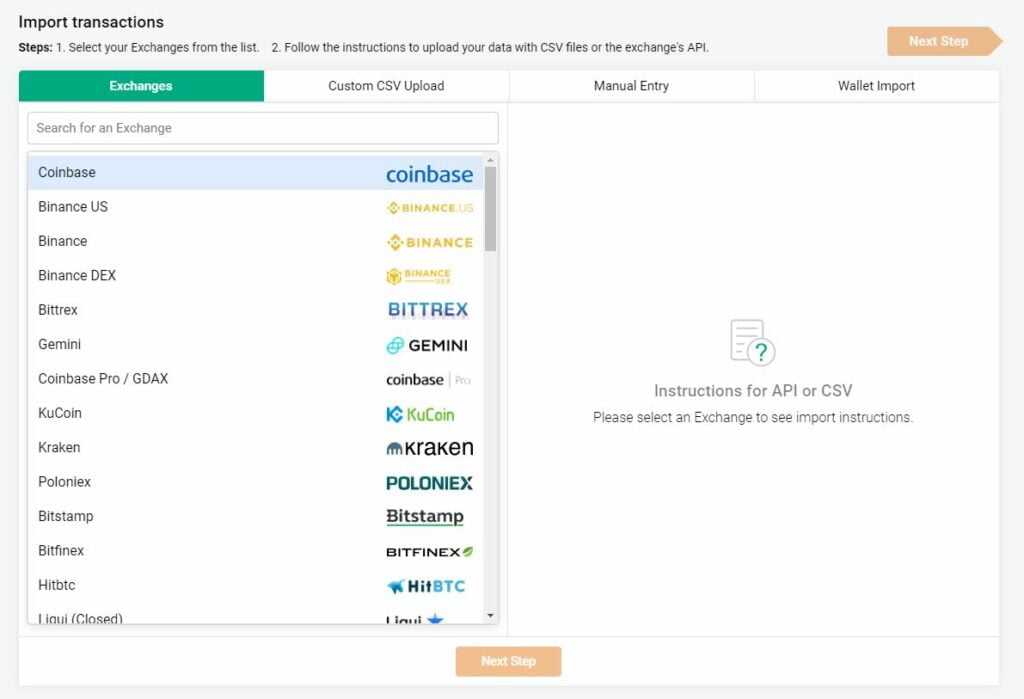

Supported Cryptocurrencies and Exchanges.

ZenLedger integrates with a big list of exchanges; you can check the full list here. But for now, let’s say it supports all the popular exchanges like Binance, Coinbase, Kraken, and more.

Also, all coins within supported exchanges are supported by ZenLedger too.

FAQ.

Is ZenLedger Easy to Use?

You can generate your tax forms after connecting your exchange and importing your transactions.

How Secure is ZenLedger?

ZenLedger connects to your exchange through an API key. Therefore, it has no permission to withdraw coins. All your assets will remain in your exchange.

Also, your information is encrypted, and no one can access any of your sensitive data.

Which Are The Supported Countries by ZenLedger?

ZenLedger doesn’t localize; however, if your country is using any of the following accounting methods, ZenLedger will generate your tax forms:

FIFI

LIFO

HIFO

Which Tax Forms Does ZenLedger Support?

In addition to FIFI, LIFO, and HIFO, ZenLedger supports the following:

IRS Form 8949

Schedule 1

Schedule D

Fincen 114 // FBAR

Tax-Loss Harvesting

Grand Unified Accounting

What’s ZenLedger’s Pricing?

ZenLedger charges you according to the number of transactions you make. Choose the suitable plan for your activities, starting at $49~$399 with a free plan.

Getting Started on ZenLedger.

Starting with ZenLedger is easy; it won’t take much of your time. During our review, we’ll explain how to create your account, connect your exchange/wallet, and generate your first form.

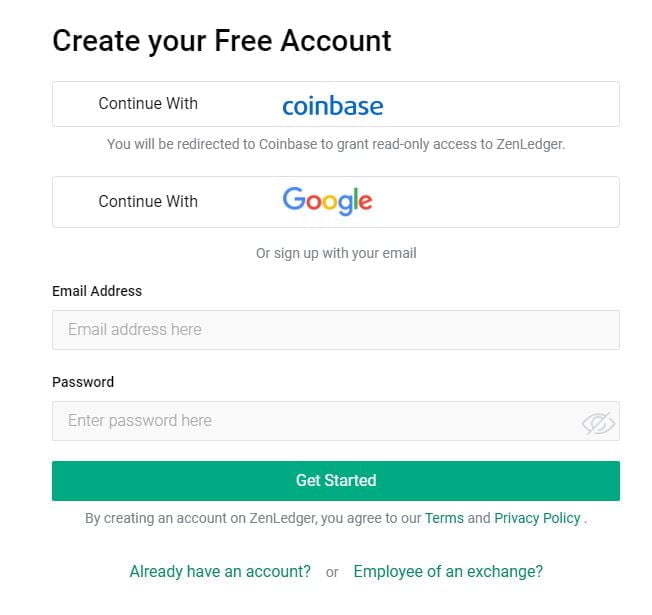

Create An Account.

First things first, Visit the ZenLedger website and start signing up; you can also sign in via Google or Coinbase.

Verify Your Account.

After signing up, check for an email from the ZenLedger team to confirm your account.

Connect an Exchange/ Wallet.

Firstly, visit your exchange and generate an API key. For wallets, you only need your public address.

On ZenLedger, paste your API key, secret API, or your wallet’s public address. Notice that you can choose to import transactions in a different way, like CSV files or manual input.

Generate Your First Tax Form.

After connecting your exchange, you can now generate your first tax form on ZenLedger.

On your dashboard, choose to generate a form, then choose the form you want to generate, and it’s only a couple of minutes until your first form is generated.

Conclusion.

Bottom line, this ZenLedger review made us like a lot about ZenLedger. But, there are some things that we didn’t like too.

So, here’s a list of ZenLedger pros and cons:

Pros.

- Great UI and customer support

- Awesome tools integrated

- Transfers Tracking

- Supports a wide range of coins

Cons.

- Doesn’t localize forms.