Digital Asset Tax Engine, built for scale & Accuracy

Software for traders & accountants to pull trades from every exchange and generate tax documents within minutes. Free income statement & free gain-loss preview.

Fyn Review And Best Alternatives

Sometimes, calculating taxes distracts you from doing what matters the most, growing your business. And calculating your taxes is a must. So what’s the solution?

Crypto tax calculators are the answer. No more wasted time or effort on doing something that will still have the chance of a human error. In this article, we’ll review one of the best in that field, Fyn.

About Fyn.

Besides saving time and effort, the Fyn platform is built for High-Frequency Traders and accounting professionals. Crunch gigantic numbers of transactions per second. Moreover, no more need to worry about an accounting expert’s human error or expenses. As Fyn is both affordable and accurate.

Fyn Features.

Income Classification.

Categorize the incoming digital assets and report them correctly on your taxes.

Smart Matching Algorithms.

Avoid unnecessary taxable events & save money on taxes. Their smart matching algorithms will help you avoid a ton of taxable events that were not actually taxable events due to latency when transferring between exchanges.

Review Transactions Before You Process.

Calculate using the right cost basis for every transaction. Besides an amazing workflow from Fyn, reviewing any transactions that don’t have the right source helps you define the right cost-basis for every transaction.

Historical Pricing for Every Cryptocurrency.

For all the supported cryptocurrencies across the supported exchanges. They have accurate historical prices. So you get assigned to the right cost-basis for every transaction.

Supported Cryptocurrencies & Exchanges.

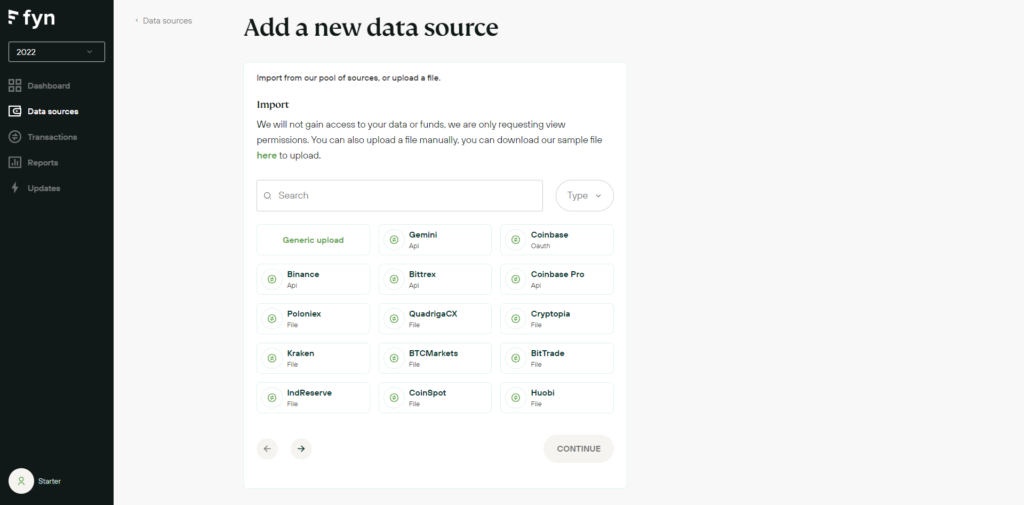

Fyn supports over 50 exchanges. However, if they don’t support your exchange, you can upload your transactions as a CSV file.

Also, they support all cryptocurrencies in any of the exchanges they support.

FAQ.

Is Fyn Easy to Use?

No, it’s not. Fyn’s interface isn’t user-friendly. Not as responsive as expected. However, if you got used to it, you’ll find no problem using it. Also, we’ll take you through the steps of getting started on Fyn to make it easier.

How secure is Fyn?

Fyn is secure as it connects to your exchange via APIs. And you upload your wallet’s transactions as a CSV file. So, no passwords or private keys are required.

Which Are The Supported Countries?

They support the USA, Canada, Australia, and India. However, if you don’t find your country, it’s okay. They support international tax reports too. -more on that later.

Which Tax Reports Does Fyn Support?

Besides supporting tax reports for the previously mentioned countries, they also support the following international tax reports.

IRS Form 8949.

Short & Long Term Sales Report.

Audit Trail Report.

TurboTax Direct Import.

Long-TermTaxAct Direct Import.

Also, they support FIFO and LIFO accounting methods.

What’s Fyn Pricings?

At the moment, there is no specific pricing for Fyn’s services. You can use their free plan or contact sales for a premium account.

Get Started on Fyn.

The most important in the Fyn review is getting started on Fyn. The process is easy. Also, we’ll take you through creating an account to generate your first tax report.

Create an Account.

Visit Fyn sign-up page and enter your information. You’ll be asked for your name, email, password, and country.

Verify Your Account.

Now you need to verify your account. Go to your email and click the link they sent you.

Connect Your Exchange And Import Data.

To connect your exchange, follow the following steps.

Firstly, Click on ‘Upload Transactions.’

Secondly, choose the exchange or wallet you want to connect to. Exchanges are connected through APIs. And for wallets, you can upload your transactions CSV; that works for exchanges too.

Generate a Tax Report.

To generate a tax report. Click on ‘Calculate Gain/Loss’. And Fyn will take you through the process of generating your first tax report.

Conclusion.

After this Fyn review, we managed to put things up for you as pros and cons.

Pros.

- Supports a wide range of tax reports.

- Supports most major exchanges and wallets.

Cons.

- Slow and complex interface.

- Hard to use at first glance.