Bitcoin and Crypto Tax Software

Accointing is the accounting, tracking, and tax optimization tool for Bitcoin and other cryptocurrencies. They are a team of passionate blockchain investors and believers that have come together to create the most comprehensive and simple-to-use taxe

Accointing Review And Best Alternatives

Calculating taxes and can take many hours of your day to fill a report; you might need to fill multiple reports. Indeed, it might be easy for casual traders, but such a process must be automated for expert traders; thus, we decided to review Accointing in this post.

Crypto tax calculators retrieve your transaction data from your exchange through API keys. That’s helpful, especially if you make many daily trades on two or more exchanges. You no longer need to keep track of your transactions on each exchange for taxes, and you can automate it.

About Accointing.

Accointing is the accounting, tracking, and tax optimization tool for Bitcoin and other cryptocurrencies. They are also a team of passionate blockchain Investors and believers who have come together to create the most comprehensive and simple-to-use taxes and tracking tool in the blockchain space.

Also Read: Recap Review and Best Alternatives.

Accointing Features.

In the following part of Accointing review, we’re putting all of the platform’s features under the spot to give you an overview of how powerful Accointing is.

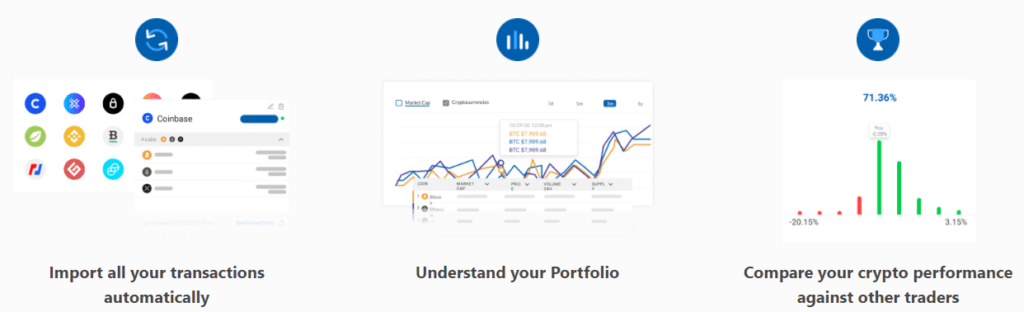

Portfolio Tracking Dashboard.

We expected Accointing to be just a crypto tax calculator, but we were impressed by how much of a comprehensive crypto platform Accointing is.

All your transactions are imported automatically after connecting your exchange/wallet to Accointing. Then, Accointing will create your portfolio, enabling you to track your performance over time to improve your trading, analyze your gains and losses and define your next moves.

Also, they have a 24h-Performance vs. Others feature, which enables you to compare your performance vs over 40,000 traders in real-time.

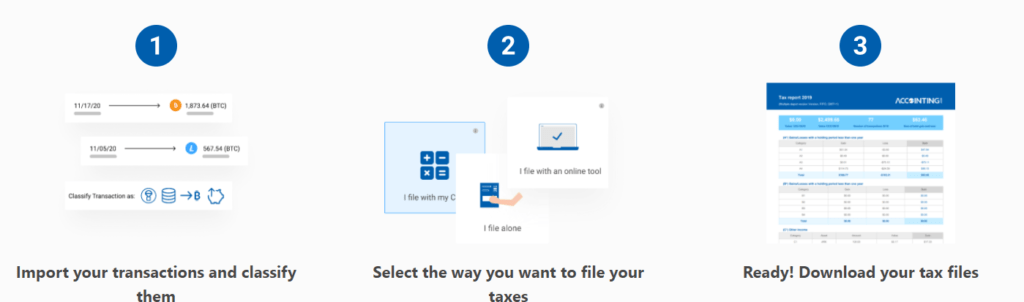

Detailed Crypto Tax Reports and Holding Period View

Once you’ve connected your exchange or wallet, Accointing can immediately calculate your gains and losses and fill in your tax report. Also, you can select the way you want to file your report to either manually or with an online tool. After that, with one click, you can download your report.

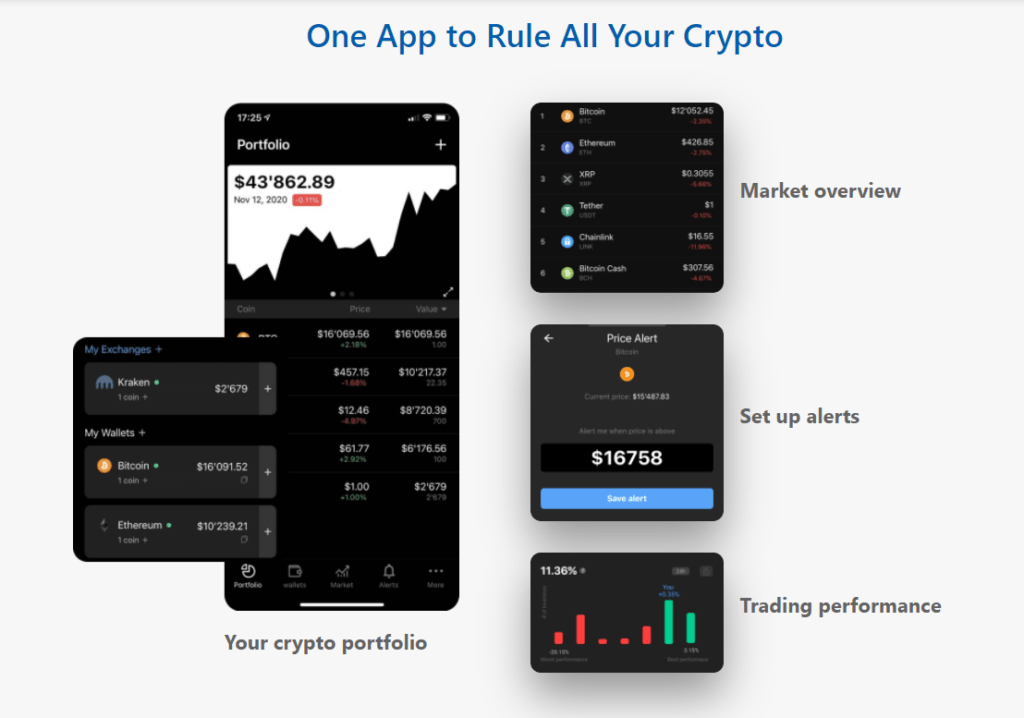

Crypto Tracker.

Accointing introduces a robust mobile application designed to empower your cryptocurrency market tracking experience. Seamlessly monitor price fluctuations, establish personalized alerts, and delve into in-depth insights concerning your investment portfolio. With this user-friendly app at your disposal, you gain the tools to stay informed about the dynamic crypto market while maintaining a proactive stance on your investment strategies.

Supported Exchanges.

Accointing supports many exchanges and wallets, including Binance, Bitfinex, Coinbase, KuCoin, and more.

FAQ.

Is Accointing Ease to Use?

Accointing has a simple and interactive UI; you can only generate your tax report within four steps. Also, everything is clear and easy to access.

Is Accointing Safe?

Accointing is safe as user data is encrypted using user-specific keys generated by the AWS Key Management System (KMS), which are also rotated according to industry standards.

Accointing explicitly asks for read-only access for API keys and encrypts user-specific data. The users can delete the whole account, including all collected data, at any point.

Which Countries Does Accointing Support?

Accointing has specific tax reports for the following countries: The United States, Germany, Austria, Switzerland, and the United Kingdom. However, If you are not from one of these countries, you can use the “general” report, which will provide all relevant tax information.

What are Accointing Plans?

Like all crypto tax calculators, Accointing charges you per tax season, and there are different plans that have different features—starting at $49~$499 plus a free plan.

Starting on Accointing.

Next, we will illustrate how you can start on Accointing, from signing up to generating your first tax report.

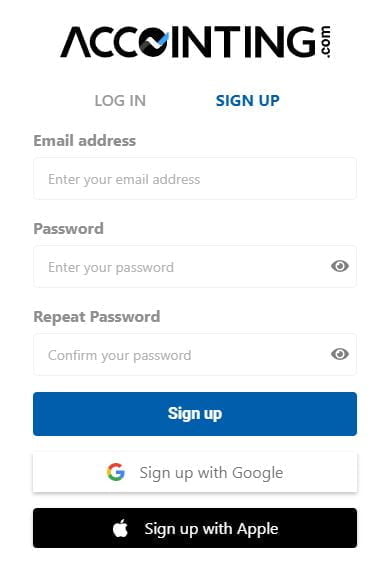

Sign-up on Accointing.

Firstly, visit Accointing website, then click on ‘Sign-in’ in the top right, then click on ‘Sign-up’. You can continue with your Google or Apple.

Connect Your Account.

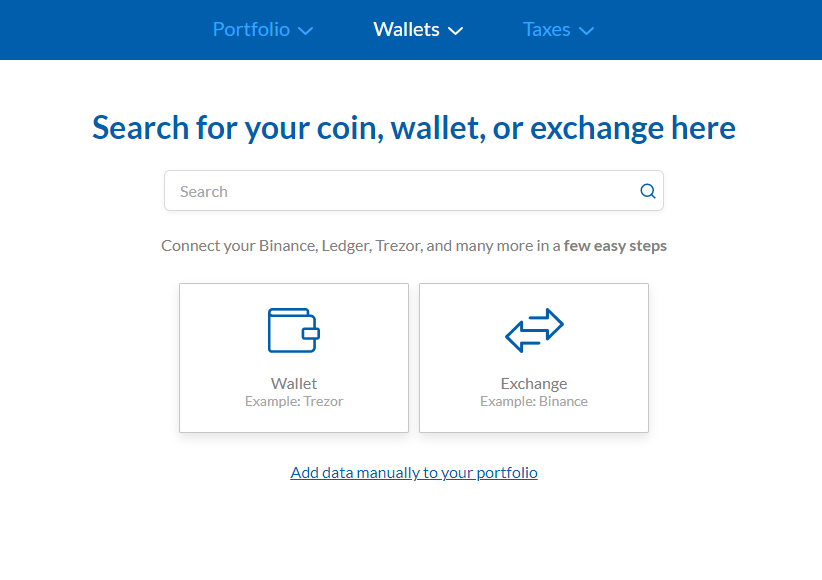

Now, on your Accointing’s dashboard, click ‘Connect A Wallet or Exchange’ and select whether you want to connect a wallet or exchange. Notice that you can also proceed with manual entry.

Exchanges are connected through API keys, and wallets connect through public keys. And Accointing will never ask for private keys.

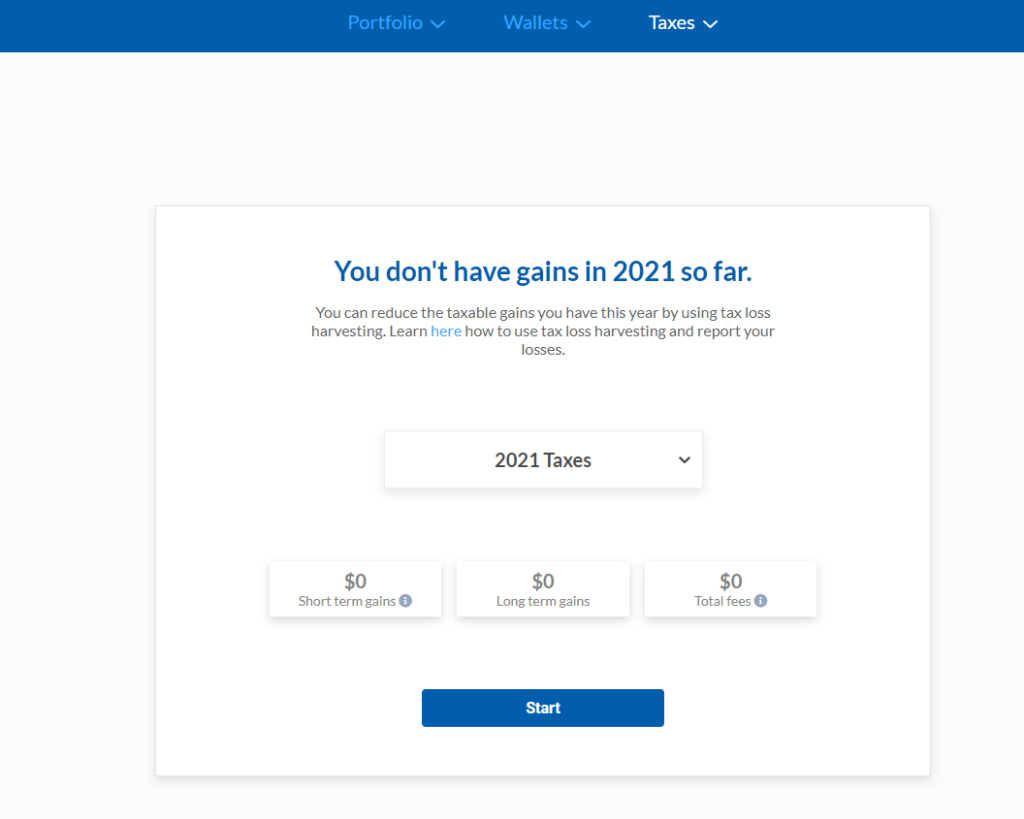

Generate A Tax Report.

Finally, click ‘Taxes’ on the top menu to generate your first tax report. After that, you can select your tax year, and Accointing will take you through selecting your report and generating it.

Conclusion.

If you’re new to crypto tax calculators, Accointing is definitely a good option to start with. Here are Accointing pros and cons.

Pros.

- Easy to use

- Localized reports

- Crypto market

- Portfolio tracker

- Supports over 300 wallets and exchanges

Cons.

- We haven’t found any cons so far!