Crypto tax calculators are essential for every trader, and throughout this list, we will cover the best crypto tax calculators.

Disclosure! This List contains links that may earn us a small commission at no extra cost to you. Our website’s metrics and compensation determine the order of the List. Please don’t consider it as ranking and evaluate items individually.Crypto Tax Software

a cryptocurrency tax calculator that has been designed to help individuals and businesses calculate their taxes accurately, with a user-friendly interface. The platform supports over 300 cryptocurrency exchanges and wallets.

Crypto Portfolio Tracker and Tax Calculator

CoinTracking is the first cryptocurrency tax reporting tool and portfolio manager. CoinTracking started to make cryptocurrency traders’ lives easier – not only during tax season.

Crypto Taxes Done in Minutes

One of the most accurate and reliable DIY tax prep software for crypto investors. With over 12 billion dollars in transaction volume and partnerships with leading consumer tax software platforms.

Calculate your crypto and NFT taxes

One of the most reliable and easy-to-use tax solution for cryptocurrencies. The platform offers an all-in-one solution for tax reporting, accounting, and portfolio management for cryptocurrency investors.

Crypto Tax Software and Accounting

Connect major exchanges like Coinbase and Binance with automatic API import, or upload a trade history CSV from any exchange to automatically generated tax forms and reports.

Crypto Tax Calculator Software

An easy-to-use tool to prepare your taxes in a matter of minutes. Over 500 integrations with support for complex scenarios such as DeFi & NFTs.

Enterprise-Grade Crypto Tax and Transaction Tracking

Node40 intersect with industry and government compliance to demystify cryptocurrency treatment (e.g., Bitcoin) across its many governing bodies.

Bitcoin and Crypto Taxes for Capital Gains and Income

One of the leading capital gains and income tax calculator for Bitcoin, Ethereum, Ripple, and other digital currencies. Bitcoin Taxes has provided services to consumers and tax professionals since its launch in 2014.

Crypto & NFT Taxes done in minutes

CoinTracker enables seamless cryptocurrency portfolio tracking and tax compliance as cryptocurrency adoption picks up and more exchanges, wallets, and DeFi products are built.

Bitcoin and Crypto Tax Software

Accointing is the accounting, tracking, and tax optimization tool for Bitcoin and other cryptocurrencies. They are a team of passionate blockchain investors and believers that have come together to create the most comprehensive and simple-to-use taxe

Tax Calculators Guide

If you’re a cryptocurrency investor or trader, it’s crucial to accurately calculate your taxes. With the rise of digital currencies, tax regulations can be complex and confusing. This is where crypto tax calculators come into play.

Crypto tax calculators are tools that automate the process of calculating your cryptocurrency taxes. They track your transactions, determine gains or losses, and generate tax reports. This not only saves you time, but it also reduces the chances of errors and helps you stay compliant with tax laws.

Whether you’re a beginner or an experienced investor, using a crypto tax calculator can make your life easier. Let’s explore this topic in-depth and understand how these tools work.

Key Takeaways

- Crypto tax calculators automate the process of calculating cryptocurrency taxes.

- They track transactions and generate tax reports, saving time and reducing errors.

- Using a crypto tax calculator can help you stay compliant with tax regulations.

- It’s important to select the best crypto tax calculator for your specific needs.

- Future advancements in these tools may include improved automation and integration with regulatory reporting systems.

What are Crypto Tax Calculators?

Crypto tax calculators are specialized tools that help cryptocurrency investors and traders calculate their tax liability in a fast, accurate, and hassle-free manner. These tools are designed to automate the process of computing cryptocurrency taxes, which can be a complex and time-consuming task without the use of a crypto tax calculator.

A crypto tax calculator is a type of crypto accounting software tool that can track transactions, determine gains or losses, and generate comprehensive tax reports. These reports can be used to fill out tax forms and submit them to tax authorities, ensuring that taxpayers comply with all relevant tax regulations and avoid penalties and fines.

How Does a Crypto Tax Calculator Work?

Crypto tax calculators work by importing transaction data from cryptocurrency exchanges, wallets, and other sources, and analyzing this data to determine the user’s tax liability. The tool uses a variety of algorithms and formulas to calculate the user’s gains or losses, taking into account factors such as the purchase price, sale price, and holding period of each asset.

Once the calculations have been completed, the crypto tax calculator generates a variety of tax reports, including capital gain tax reports and other relevant forms. These reports can be exported to popular tax preparation software tools or printed out for manual submission.

Crypto tax calculators are easy to use, and most do not require any specialized technical knowledge or skills. They are typically designed with an intuitive user interface that allows users to input data and generate reports with just a few clicks.

Overall, crypto tax calculators are an essential tool for cryptocurrency investors and traders who want to ensure that they are complying with all relevant tax regulations and avoiding any potential penalties and fines. With the help of a crypto tax calculator, users can accurately and efficiently calculate their tax liability, saving time and reducing the risk of errors and mistakes.

Types of Crypto Tax Reports:

Crypto tax calculators generate various reports relevant to cryptocurrency taxation. One of the most critical tax reports is a capital gain tax report, which outlines the gains or losses made from cryptocurrency transactions. Capital gain tax on crypto is typically calculated based on the difference between the purchase price and the selling price of the asset, adjusted for factors such as transaction fees and mining expenses.

Other types of crypto tax reports include income tax reports, which outline the income earned from cryptocurrency activities, and donation reports, which outline the value of cryptocurrency donations made to charitable organizations. Crypto tax reports are designed to make the process of cryptocurrency tax reporting simpler and more efficient, as they enable users to quickly and accurately determine their tax liability.

Countries that don’t Tax Crypto.

There are few countries that do not tax cryptocurrency at any even; therefore, you do not need a tax calculator at all. The crypto-friendly countries are:

- Belarus

- Germany

- Hong Kong

- El Salvador

- Malaysia

- Malta

- Portugal

- Singapore

- Slovenia

- Switzerland

- Bermuda

- United Arab Emirates

Countries that Tax Crypto

Cryptocurrency taxation varies significantly across different countries. While some nations have embraced cryptocurrencies and offer tax breaks to investors, others have imposed stringent regulations and hefty taxes on crypto transactions. Here, we will provide an overview of the countries that impose taxes on cryptocurrencies and their varying tax regulations.

United States

One of the world’s largest cryptocurrency markets, the United States taxes cryptocurrencies as property. This means that cryptocurrency transactions are subject to capital gains tax, with tax rates ranging from 0% to 37%, depending on the holding period and the amount of gains made. Additionally, certain states also impose their own cryptocurrency taxes.

United Kingdom

In the United Kingdom, cryptocurrency transactions are subject to capital gains tax, with tax rates ranging from 10% to 28%, based on the taxpayer’s income. There are also specific tax rules for mining and staking cryptocurrencies.

Germany

Germany taxes cryptocurrencies as private money, subject to a capital gains tax of 25%, with no tax exemptions for cryptocurrencies held for more than a year. Cryptocurrency miners are also required to pay income tax on their mining rewards.

Japan

Japan was one of the first countries to legalize cryptocurrencies and imposes a tax on cryptocurrency transactions based on the taxpayer’s income, with rates ranging from 15% to 55%. Cryptocurrency exchanges in Japan are also required to pay taxes on their profits.

China

China has imposed strict regulations on cryptocurrencies, banning domestic cryptocurrency exchanges and initial coin offerings. However, cryptocurrencies are not explicitly illegal in China, and individuals are still required to pay taxes on their cryptocurrency gains.

South Korea

South Korea has a progressive tax system for cryptocurrencies, with tax rates ranging from 20% to 42%, depending on the amount of gains made. Cryptocurrency exchanges in South Korea are also required to pay taxes on their profits.

Conclusion

It is essential to stay informed about the varying tax regulations in different countries to avoid penalties and ensure compliance. Crypto tax calculators can simplify the process of calculating taxes and generating tax reports for a hassle-free experience.

How Crypto Tax Calculators Work

Crypto tax calculators are specialized tools designed to automate the process of calculating cryptocurrency taxes. These tools streamline the tax computation process by tracking transactions, determining gains or losses, and generating comprehensive tax reports.

The Process of Using Crypto Tax Calculators

The first step in using a crypto tax calculator is to import transaction data from various sources like cryptocurrency exchanges or wallets. Once the data is imported, the calculator performs the necessary calculations based on the specific tax laws and regulations in the user’s jurisdiction. Finally, the calculator generates detailed tax reports that users can use to file their taxes with ease.

Some of the advanced crypto tax calculators also offer features like real-time tracking of transactions and integration with popular accounting software tools. These features help users stay updated with their tax calculations and make informed trading decisions.

The Benefits of Using Accounting Software Tools for Crypto Tax Calculations

In addition to dedicated crypto tax calculators, there are also accounting software tools that are specifically designed to manage cryptocurrency taxes.

The main benefit of using accounting software tools is that they allow users to manage all their financial transactions and investments in one place. This helps users get a complete picture of their financial status and make informed investment decisions.

Additionally, accounting software tools offer advanced features like automatic data import, support for multiple exchanges and wallets, and real-time tracking of transactions. These features help users save time and reduce errors.

Key Features to Look for in Crypto Tax Calculators and Accounting Software Tools

When selecting a crypto tax calculator or accounting software tool, users should look for features like:

- Automatic data import from popular cryptocurrency exchanges and wallets

- Real-time tracking of transactions

- Support for multiple cryptocurrencies

- Integration with accounting software tools

These features help users save time and reduce errors when computing their cryptocurrency taxes.

In conclusion, crypto tax calculators and accounting software tools are essential for accurate and hassle-free cryptocurrency tax computation. By selecting a tool that meets their specific needs, users can streamline their tax calculation process and focus on making informed investment decisions.

Selecting the Best Crypto Tax Calculator

With the increasing popularity of cryptocurrencies and the need to comply with tax regulations, the demand for crypto tax calculators has surged. However, with so many options available, it can be challenging to select the best one. Here are some tips to help you choose:

Consider the Features

One of the most important factors to consider when selecting a crypto tax calculator is its features. Look for calculators that offer automatic data import, support for multiple exchanges, and real-time tracking. In addition, check if the calculator integrates with popular accounting software tools.

Check Pricing Options

Another consideration is the pricing options. Some crypto tax calculators offer a free version that may have limited features, while others require a subscription or a one-time fee. Choose the option that fits your budget and offers the necessary features.

Read User Reviews

Before making a final decision, read reviews of the crypto tax calculator you are considering. This will give you an idea of the user experience and any potential issues. Look for reviews from verified users to get a more accurate representation of the calculator’s effectiveness.

Check Compatibility with Exchanges

If you use a specific cryptocurrency exchange, check if the crypto tax calculator supports it. For example, if you use Binance, look for a Binance tax calculator that can import transaction data from the exchange and perform accurate calculations.

Consider Free Options

If you are on a tight budget, consider using a free crypto tax calculator. While these calculators may not have all the features of paid options, they can still provide accurate tax calculations and help you stay compliant with tax regulations.

By considering these factors, you will be able to select the best crypto tax calculator for your specific needs. This will make tax computation a hassle-free process and ensure that you stay compliant with tax regulations.

Understanding Capital Gains Tax on Crypto

Capital gains tax is a tax on the profits made from selling or disposing of an asset such as property or stocks, including cryptocurrency. In the US, the capital gains tax rate for cryptocurrencies is determined by how long the asset was held before selling.

Short-term Capital Gains Tax

Short-term capital gains tax is applied to profits made from selling cryptocurrency that was held for less than a year. The tax rate is the same as the individual’s income tax bracket, which ranges from 10% to 37%.

Long-term Capital Gains Tax

Long-term capital gains tax is applied to profits made from selling cryptocurrency that was held for more than a year. The tax rate is 0%, 15%, or 20%, depending on the individual’s income bracket.

Reporting Capital Gains Tax on Crypto

Capital gains tax on cryptocurrency must be reported on the taxpayer’s tax return. It is recommended to keep a record of all cryptocurrency transactions, including the purchase price, sale price, and date of purchase and sale.

Crypto tax calculators can be useful in accurately tracking and calculating capital gains tax on cryptocurrency. By automating the process of computing taxable gains and losses, these tools can save time and ensure compliance with tax regulations.

The Benefits of Using Crypto Tax Calculators

As the world of cryptocurrency evolves, so do the complexities of tax regulations and reporting requirements. With the increasing number of transactions that investors make with their digital assets, calculating tax liabilities can be daunting and time-consuming. This is where crypto tax calculators come in handy.

Crypto tax calculators are software tools specifically designed to automate the process of calculating taxes on cryptocurrency investments. They can accurately track transactions, determine gains or losses, and generate comprehensive tax reports with ease.

Here are some of the benefits of using crypto tax calculators:

1. Saves Time and Reduces Errors

Calculating taxes on cryptocurrency investments manually can be a tedious and error-prone process. Using crypto tax calculators can save time and reduce the risk of errors. These tools can import transaction data from exchanges, wallets, and other sources, thus minimizing the need for manual data entry. This reduces the chances of errors and ensures accurate tax calculations.

2. Provides Accurate Tax Calculations

Crypto tax calculators use sophisticated algorithms to calculate tax liabilities on cryptocurrency investments. They take into account various factors such as the holding period, cost basis, and capital gains to provide accurate tax calculations. This ensures that investors pay the correct amount of taxes and stay compliant with tax regulations.

3. Offers Comprehensive Financial Management

Crypto tax calculators can be integrated with accounting software tools to provide comprehensive financial management. This allows investors to track their assets, monitor their portfolio performance, and manage their tax liabilities in a single platform. This can save time and increase efficiency in financial management.

4. Provides Peace of Mind

By using crypto tax calculators, investors can rest assured that they are accurately calculating their tax liabilities and staying compliant with tax regulations. This can provide peace of mind and reduce the stress that comes with tax season.

Overall, crypto tax calculators are essential tools for accurately computing cryptocurrency taxes. They save time, reduce errors, and provide comprehensive financial management. By selecting the most suitable crypto tax calculator, investors can maximize the benefits of these tools and stay ahead of the ever-changing crypto tax landscape.

Features to Look for in Crypto Tax Calculators

Choosing the right crypto tax calculator can be overwhelming for many users. There are certain features that users should consider when selecting the most suitable option. Below are some of the key features to look for in crypto tax calculators and crypto accounting software tools:

Automatic Data Import

The automatic data import feature allows users to upload transaction data directly from their cryptocurrency exchanges. This feature saves time and reduces the risk of errors in manual data input.

Support for Multiple Exchanges

Since different cryptocurrency exchanges have varying transaction formats, support for multiple exchanges is important. A good crypto tax calculator should support all major exchanges to ensure seamless tax calculations.

Real-Time Tracking

Real-time tracking feature provides users with up-to-date information on their transactions and tax liabilities. This feature helps users monitor their tax situation and make timely decisions.

Integration with Accounting Software

Integration with accounting software enables users to manage their cryptocurrency portfolio and tax liabilities in one place. This feature provides users with a comprehensive financial management solution.

These are just a few examples of the features to look for in crypto tax calculators and crypto accounting software tools. Selecting a tool that best suits your specific needs can save time, reduce errors, and provide accurate tax calculations.

Tips for Efficiently Using Crypto Tax Calculators

Using crypto tax calculators can save time and reduce errors in calculating cryptocurrency taxes. To maximize their efficiency, here are some tips and best practices:

1. Organize your transaction data

Ensure that your transaction data is properly categorized and organized to avoid errors in tax calculation. Keep track of your transactions in a spreadsheet or accounting software that can be easily imported into the crypto tax calculator.

2. Ensure accurate data input

Double-check all data input to ensure accuracy. A small mistake in transaction data can lead to significant errors in tax calculation.

3. Stay updated with tax regulations

Keep yourself informed about any changes in tax regulations that may affect your cryptocurrency investments. This will ensure that your tax calculations remain accurate and up-to-date.

4. Use crypto accounting software tools

Consider using crypto accounting software tools that are specifically designed to integrate with crypto tax calculators. This can simplify the process of importing transaction data and ensure accurate and streamlined tax calculation.

5. Take advantage of real-time tracking

Many crypto tax calculators offer real-time tracking of transactions, providing up-to-date information for accurate tax calculations. Use this feature to ensure timely and accurate reporting of your cryptocurrency taxes.

6. Evaluate the accuracy of your results

After using a crypto tax calculator, check the accuracy of your results against your own calculations or those of a tax professional. This can help identify any errors and ensure that your tax reporting is accurate.

7. Keep records and receipts

Keep records and receipts of all cryptocurrency transactions to ensure accurate and efficient tax reporting. This will simplify the process of organizing and categorizing transaction data for use with a crypto tax calculator.

Conclusion

By following these tips, you can efficiently and effectively use crypto tax calculators to accurately calculate your cryptocurrency taxes and ensure compliance with tax regulations. Consider using crypto accounting software tools and staying informed about tax regulations to optimize your tax calculation process.

Common Challenges with Crypto Tax Calculators

While crypto tax calculators are designed to simplify the process of computing cryptocurrency taxes, they are not without their challenges. Here are some common issues that users may encounter when using these tools:

1. Data Integration

One of the most common challenges with crypto tax calculators is integrating data from multiple sources. Users may need to import data from various cryptocurrency exchanges, wallets, and other platforms, which can be time-consuming and frustrating.

2. Accuracy of Calculations

Another potential issue with crypto tax calculators is the accuracy of calculations. While these tools are designed to automate the process of computing cryptocurrency taxes, there may be discrepancies in calculations due to incorrect data input or other factors.

3. Staying Compliant with Changing Tax Laws

Crypto tax laws are constantly evolving, and it can be challenging for users to stay up-to-date with the latest regulations. As a result, users may struggle to ensure that their tax calculations are compliant, which can lead to penalties and other consequences.

Solutions and Resources

Fortunately, there are several solutions and resources available to help users overcome these challenges. For data integration issues, users can look for crypto tax calculators that support multiple exchanges and wallets, and that can automatically import transaction data. For accuracy issues, users can double-check their data input and consult tax professionals if necessary. And, for compliance issues, users can stay updated with the latest tax regulations and use compliance tools and resources provided by regulatory authorities.

By being aware of these common challenges and utilizing the available solutions and resources, users can optimize their experience with crypto tax calculators and ensure accurate and compliant tax computations.

Future Trends in Crypto Tax Calculators

The world of cryptocurrencies is constantly evolving, and so too are the tools used to manage them. Crypto tax calculators are no exception, with several exciting future trends on the horizon.

Automation

One major trend in the development of crypto tax calculators is increased automation. As cryptocurrencies become more widely adopted, the volume of transactions and data needing to be processed will increase exponentially. Automated tools can help users import, categorize, and calculate these transactions with greater speed and accuracy.

Integration with Regulatory Reporting Systems

Another area of development is the integration of crypto tax calculators with regulatory reporting systems. As governments around the world seek to regulate and tax cryptocurrencies, users will require tools that can facilitate compliance with these requirements. By integrating with regulatory reporting systems, crypto tax calculators can help users stay on top of these obligations.

Improved User Interfaces

Finally, the development of more intuitive and user-friendly interfaces is an important trend in the world of crypto tax calculators. By simplifying the process of calculating cryptocurrency taxes, these tools can become accessible to a wider range of users, including those with limited technical knowledge or experience with cryptocurrencies.

- Crypto Tax Calculators – these tools are becoming increasingly sophisticated, accommodating for a wide variety of user needs and providing increased automation and more intuitive interfaces.

- Cryptocurrency Taxes Calculator – as the world of cryptocurrencies matures, governments are increasingly seeking to regulate and tax these assets. Cryptocurrency taxes calculators are becoming essential tools for helping users stay compliant with these requirements.

As the world of cryptocurrencies continues to evolve, the development of more sophisticated and user-friendly crypto tax calculators will play a crucial role in helping users manage their tax obligations.

IRS Definition of Cryptocurrency.

The IRS defines cryptocurrency as follows:

“Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and a store of value other than a representation of the United States dollar or a foreign currency.”

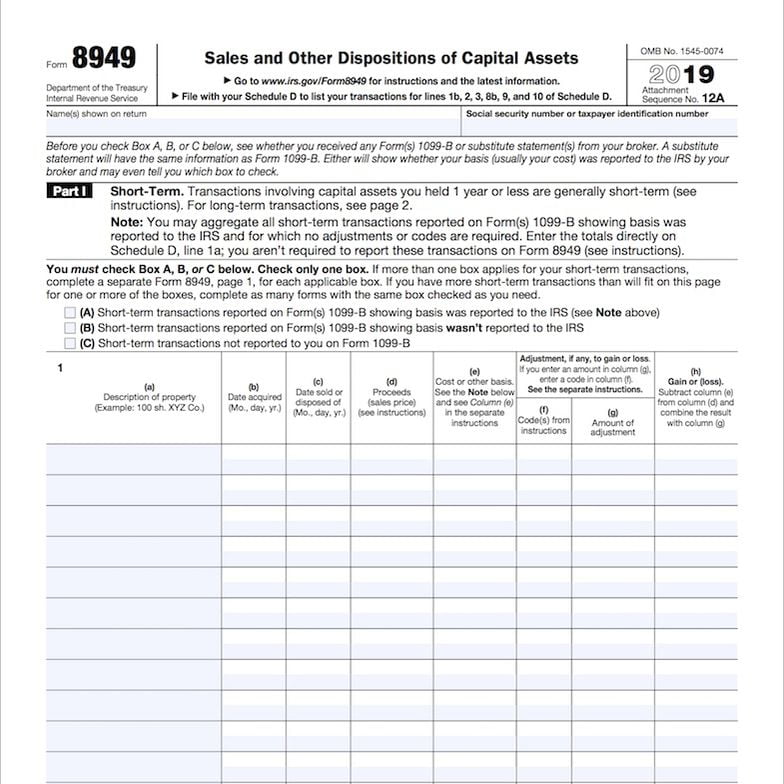

Crypto Tax Forms.

The form you should be using depends on your country. Make sure to check your country’s laws; here are some international accounting methods:

- First in, first out (FIFO)

- Last in, first out (LIFO)

- Highest in, first out (HIFO)

- Adjusted cost base (ACB) – Canada

- Share pool – United Kingdom

And for U.S residents, these are the most important forms that your calculator should support:

- Form 8949 (used for cryptocurrency capital gains and losses)

- The Form 1040 Schedule 1 (used to report income made in crypto)

Conclusion

As the world of cryptocurrency continues to expand, it is crucial for investors and traders to accurately calculate their taxes. Crypto tax calculators are powerful tools that can simplify this process by automating key calculations and generating comprehensive tax reports.

When selecting a crypto tax calculator, it is important to consider factors like features, pricing, and compatibility with popular cryptocurrency exchanges. Additionally, users should be aware of the specific tax regulations in their country or region and select a tool that can accommodate those requirements.

The benefits of using crypto tax calculators are numerous, including time savings, reduced errors, and accurate tax computations. Furthermore, dedicated crypto accounting software can provide a comprehensive financial management solution beyond just tax calculations.

While there are certainly challenges associated with using crypto tax calculators, such as data integration and staying compliant with changing tax laws, there are also numerous resources available to help users overcome these obstacles.

Looking to the future, we can expect continued advancements in automation and integration with regulatory reporting systems, as well as improved user interfaces to make tax calculations even more seamless.

Overall, the importance of crypto tax calculators cannot be overstated. By selecting the right tool, staying informed about tax regulations, and practicing good data management habits, investors and traders can accurately calculate their taxes and enjoy hassle-free investing.

Tax Calculators F.A.Q

What are crypto tax calculators?

Crypto tax calculators are tools designed to automate the process of calculating cryptocurrency taxes. They track transactions, determine gains or losses, and generate comprehensive tax reports.

What types of crypto tax reports can be generated?

Crypto tax calculators can generate various types of tax reports, including capital gain tax reports. These reports are essential for reporting profits made from cryptocurrency investments.

Which countries tax cryptocurrencies?

Several countries impose taxes on cryptocurrencies. The tax regulations vary across jurisdictions. Crypto tax calculators can help users navigate these complexities.

How do crypto tax calculators work?

Crypto tax calculators work by importing transaction data, performing calculations, and generating comprehensive tax reports. They streamline the process and provide accurate tax calculations.

How can I select the best crypto tax calculator?

When selecting a crypto tax calculator, consider factors such as features, pricing, user reviews, and compatibility with popular cryptocurrency exchanges like Binance. There are also free options available for those on a budget.

What is capital gains tax on crypto?

Capital gains tax on crypto refers to the tax imposed on the profits made from cryptocurrency investments. It involves different tax rates, holding periods, and reporting requirements.

What are the benefits of using crypto tax calculators?

Using crypto tax calculators saves time, reduces errors, and provides accurate tax calculations. Dedicated crypto accounting software can also offer comprehensive financial management.

What features should I look for in crypto tax calculators?

Look for features like automatic data import, support for multiple exchanges, real-time tracking, and integration with accounting software when choosing a crypto tax calculator.

What are tips for efficiently using crypto tax calculators?

To efficiently use crypto tax calculators, organize transactions, ensure accurate data input, and stay updated with tax regulations. Follow best practices to maximize effectiveness.

What are common challenges with crypto tax calculators?

Common challenges with crypto tax calculators include data integration, accuracy of calculations, and staying compliant with changing tax laws. Solutions and resources are available to overcome these challenges.

What are the future trends in crypto tax calculators?

Future trends in crypto tax calculators include advancements in automation, integration with regulatory reporting systems, and improved user interfaces for seamless tax calculations.

Is It Safe to Connect Tax Calculators to Wallets or Exchanges?

Yes. As tax calculators are connected to exchanges through API codes, you’re the one who controls permissions granted with every API key you generate. Your assets will remain on your exchange.

Also, tax calculators can connect to your wallet through your wallet’s public key which is totally safe.

Furthermore, most companies nowadays (If not all) encrypt your data on servers to ensure more security. We highly recommend reading about the platform’s security measures before using it.

What Are Crypto Taxing Events?

Under U.S tax law, some events make your taxes apply to your crypto once those events happen. But, firstly, let’s exclude the event when you buy crypto and hold it. Because if you didn’t trade your crypto and just held it, you don’t need to pay taxes.

Accepting crypto as payment: If you accept crypto as a payment you need to pay taxes.

Crypto mining: Miners pay taxes depending on the scale of their earnings.

Trading: Suppose you traded with your assets. Therefore, you must record your capital gain or loss as you’ll pay taxes for it.

What is FIFO vs LIFO?

FIFO and LIFO are short-hand names for inventory systems. In a FIFO system, inventory is sold on a first-in, first-out basis. In simpler words, this means the older stock is sold first. But in a LIFO system, the last in is the first out.

The same with cryptocurrency. That’s why most traders use the FIFO system, selling their oldest crypto first because that offers lower taxes as it allows you to sell long-term assets before short-term assets and long-term gains have lower taxing rates.

Is Transferring Crypto from A Wallet to Another Taxable?

It depends, if you’re transferring assets from a wallet of your own to another wallet of your own, it’s not taxable. But, if you are transferring assets to someone else, you need to pay taxes because the IRS views this as a sale.

How to Reduce Taxes by Considering Losses?

When filing your tax return, you have a few options if you have a loss. Losses in crypto can offset other capital gains, or you can carry forward the losses to future years to offset gains in crypto or other capital gains.

You can also subtract up to $3,000 of your losses from your income. If you deduct $3,000 from your income but have more losses than that, you can still carry the rest of the losses to deduct from future years or offset future gains.

Crypto tax calculators can automate that process for you and display opportunities to lower your taxes.