Calculate your crypto and NFT taxes

One of the most reliable and easy-to-use tax solution for cryptocurrencies. The platform offers an all-in-one solution for tax reporting, accounting, and portfolio management for cryptocurrency investors.

Coinpanda Review And Best Alternatives

Coinpanda Review: A Comprehensive Guide to Cryptocurrency Tax Reporting

The rise of cryptocurrency has led to new challenges in tax reporting and accounting. Keeping track of your cryptocurrency transactions and calculating your capital gains and losses can be a daunting task, especially if you trade on multiple exchanges or hold multiple cryptocurrencies. That’s where Coinpanda comes in.

Coinpanda is a cryptocurrency tax reporting and portfolio management platform that simplifies the process of calculating taxes on your crypto investments. In this Coinpanda review, we’ll take a detailed look at the features and benefits of Coinpanda, and help you decide if it’s the right tool for your needs.

Overview of Coinpanda

Coinpanda is a Finnish-based company that was founded in 2018. The platform offers an all-in-one solution for tax reporting, accounting, and portfolio management for cryptocurrency investors. The platform supports over 300 exchanges and wallets, making it easy to import your transactions and generate accurate tax reports.

One of the standout features of Coinpanda is its user-friendly interface. The platform is easy to navigate, and the streamlined design makes it easy to find the information you need. The platform is also available in multiple languages, including English, Finnish, Swedish, and Norwegian.

Coinpanda Features

- Tax Reporting

Coinpanda makes it easy to calculate your capital gains and losses for tax purposes. The platform automatically imports your transaction data from exchanges and wallets, and calculates your tax liability based on your country’s tax laws. The platform supports tax reporting for over 40 countries, including the US, UK, Canada, and Australia.

Coinpanda’s tax reporting features are customizable, allowing you to select the tax year and the specific cryptocurrencies you want to report on. The platform generates a detailed tax report that includes your capital gains and losses, income from mining, staking, and airdrops, and any other taxable events.

- Portfolio Management

Coinpanda’s portfolio management features allow you to track the performance of your cryptocurrency investments. The platform provides a real-time view of your portfolio’s value, as well as your holdings, cost basis, and profit/loss. You can also track your cryptocurrency transactions, view your transaction history, and generate detailed reports.

Coinpanda’s portfolio management features are customizable, allowing you to view your portfolio in multiple currencies and track the performance of specific cryptocurrencies or exchanges.

- Data Import

Coinpanda makes it easy to import your transaction data from exchanges and wallets. The platform supports over 300 exchanges and wallets, including Binance, Coinbase, and Kraken. You can import your transaction data manually or connect your exchanges and wallets to Coinpanda via API keys.

Coinpanda’s data import features are designed to be user-friendly and intuitive. The platform automatically matches transfers between your own wallets, and can detect and reconcile any errors or duplicates in your transaction data.

- Security

Coinpanda takes security seriously. The platform uses bank-grade security measures to protect your data and transactions. All data transfers are encrypted using SSL, and the platform uses two-factor authentication to ensure that only authorized users can access your account.

Coinpanda also offers a privacy-first approach to data collection. The platform does not store any personally identifiable information, and all transaction data is anonymized.

- Customer Support

Coinpanda offers excellent customer support. The platform provides detailed documentation and tutorials, and its support team is available via email and live chat. The support team is responsive and knowledgeable, and can help you with any questions or issues you may encounter while using the platform.

Pros and Cons of Coinpanda

Pros:

- User-friendly interface

- Supports over 300 exchanges and wallets

- Customizable tax reporting and portfolio management features

- Bank-grade security measures

- Excellent customer support

Cons:

- No mobile app

- Limited availability in some countries

- Not free

Coinpanda Pricing

Coinpanda offers three pricing tiers: Basic, Premium, and Pro. The Basic plan is free and allows you to import up to 25 transactions per month. The Premium plan costs $99 per year and allows you to import up to 5000 transactions per year. The Pro plan costs $399 per year and allows you to import up to 50,000 transactions per year.

Supported Cryptocurrencies & Exchanges.

Coinpanda integrates with over 350 exchanges, wallets, and blockchains. Besides, they support every crypto supported by the exchanges they support.

Also, they have historical data for all cryptos. And you can upload your transactions via CSV file or import from an exchange connected with an API key.

FAQ.

Is Coinpanda Easy to Use?

Coinpanda is relatively easy to use. Yes, if you’re new to Coinpanda, you’ll take your time to get used to it. But the overall experience is good.

Is Coinpanda Safe?

Yes, as they don’t require your passwords or private keys. Your exchanges are connected through APIs and wallets through public keys or addresses. And they’re both safe and secure.

Which Are The Supported Countries?

Coinpanda can calculate crypto taxes for every country that uses one of the following supported cost basis methods:

FIFO (First In, First Out), LIFO (Last In, First Out), HIFO (Highest In First Out), ACB (Average Cost Basis), Adjusted Cost Base, Share Pool

That includes USA, Canada, UK, Germany, Brazil, Peru, and more than 60 other countries.

Which Tax Reports Does Coinpanda Support?

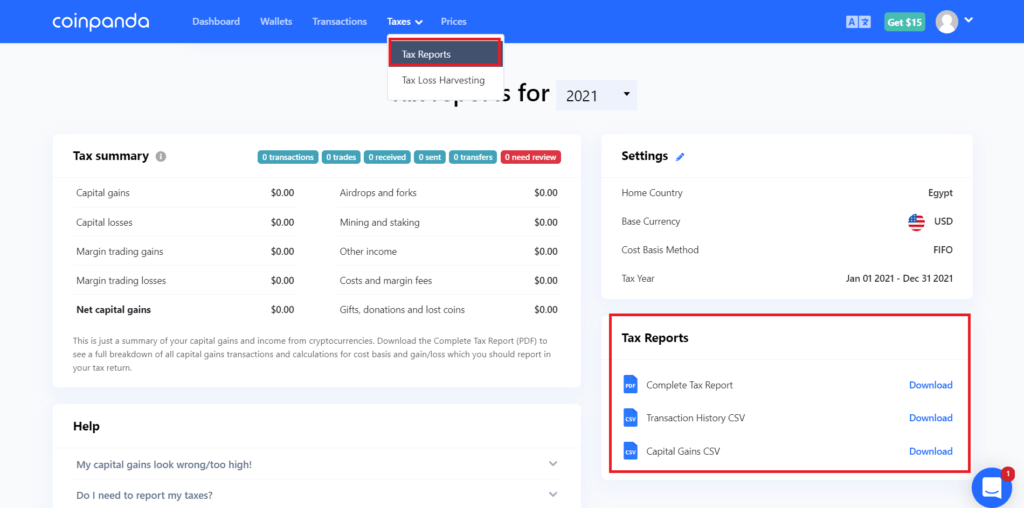

In addition to the wide range of supported exchanges and countries, Coinpanda supports the following tax reports:

Complete Tax Report, Transaction History, Capital Gains, Complete Tax Report, Transaction History, Capital Gains

Also, there are some localized tax reports too.

IRS Form 8949 and Schedule D (USA), Skatteverket K4 (Sweden), Skatteetaten RF-1159B (Norway)

And also, Coinpanda supports tax reports for other taxes software, like:

TurboTax online file, TurboTax CD/Download file, TaxAct Export

What’s Coinpanda Pricings?

Starting at $49 up to $189 with a free plan. Also, you pay per tax year. According to how many transactions you made, choose a plan with at least that amount of transactions.

Get Started on Coinpanda.

We’ll take you through every step of getting started on Coinpanda. Also, the process is easy and straightforward. It’ll take you only a few minutes.

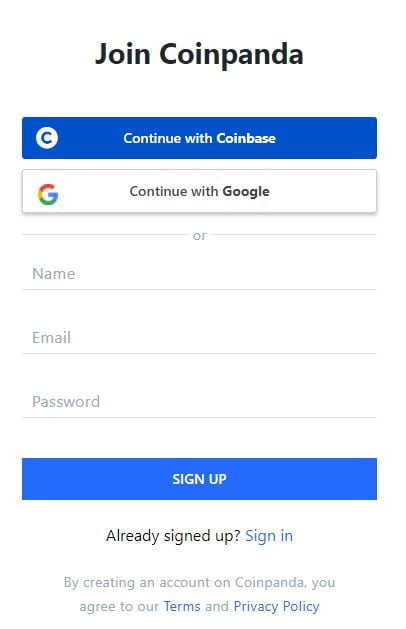

Create an Account.

To create an account on Coinpanda, visit Coinpanda sign-up page. Then, enter your information. And remember to use a robust and unique password. You can also continue via Coinbase or Google.

Verify Your Account.

Similar to all sign-up processes. Check your email for a verification link to complete the process.

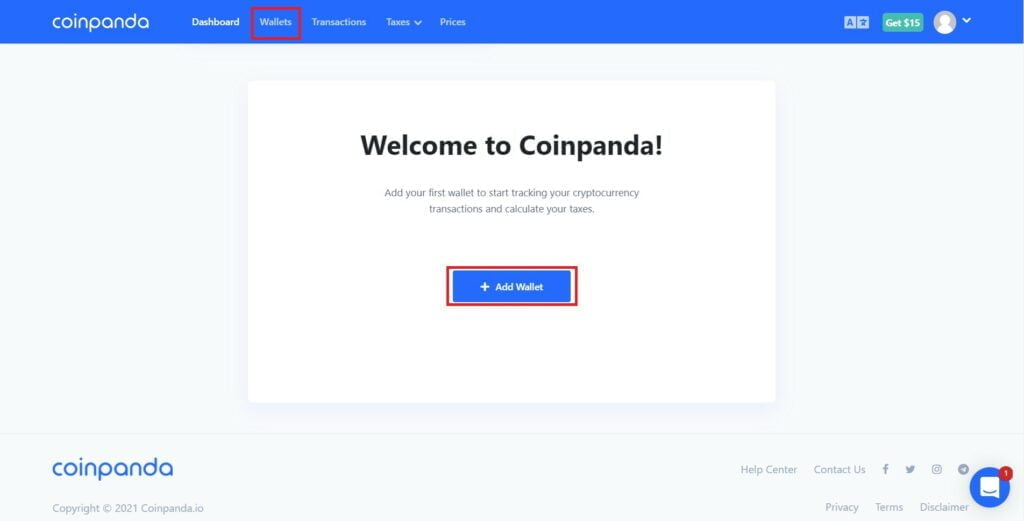

Connect Your Exchange And Import Data.

Besides all the features in Coinpanda, Connecting your exchange and importing data is accessible. Follow the following steps to fire up.

Firstly, on the top bar, click on ‘Wallets.’

Now, click ‘Add new wallet’; choose the exchange/wallet you want to connect with.

You can use a CSV file or connect via a public address for wallets.

And for exchanges, you can also choose a CSV file or API key for auto-sync.

Generate a Tax Report.

Generating a tax report will be easy, and we’ll take you through the steps in this Coinpanda review.

Firstly, Click on ‘taxes’ on the top bar. Then, choose the type of tax report you want to generate on the bottom left.

Final Thoughts

Coinpanda is an excellent tool for cryptocurrency investors who need a comprehensive solution for tax reporting, accounting, and portfolio management. The platform’s user-friendly interface, customizable features, and excellent customer support make it a standout in the cryptocurrency space.

While there are some limitations to Coinpanda, such as the lack of a mobile app and limited availability in some countries, the platform’s strengths far outweigh its weaknesses. If you’re looking for a reliable and efficient way to manage your cryptocurrency investments and tax reporting, Coinpanda is definitely worth considering.