Crypto & NFT Taxes done in minutes

CoinTracker enables seamless cryptocurrency portfolio tracking and tax compliance as cryptocurrency adoption picks up and more exchanges, wallets, and DeFi products are built.

CoinTracker Review And Best Alternatives

As more users venture into the world of cryptocurrency, managing digital assets and keeping track of taxes becomes increasingly complicated. That’s where CoinTracker steps in. Our in-depth CoinTracker review aims to provide you with essential insights into the platform’s capabilities and how it stacks against other best crypto coin tracking apps in the market. We’ll not only discuss the main features of CoinTracker but also present you with viable CoinTracker alternatives to suit different investor needs.

Create an image of a digital coin tracker with multiple options for comparison. Show imagery of charts and graphs to represent data analytics. Include various cryptocurrency logos to highlight the different options for tracking coins. Demonstrating CoinTracker and its alternatives side by side, showcase the features that make them unique while emphasizing the ability to monitor and manage cryptocurrency assets effectively.

Key Takeaways

- An overview of CoinTracker and its core functionalities

- How it simplifies managing and tracking cryptocurrency taxes

- Explanation of CoinTracker’s pricing and the value it offers

- Security measures in place to safeguard user data and privacy

- Alternatives to CoinTracker and comparisons to find the right fit

- Emphasis on personalizing the crypto-tracking experience

- Exploring additional solutions for comprehensive portfolio management

Understanding CoinTracker and Its Role in Crypto Management

CoinTracker is a powerful tool designed to help you manage your cryptocurrency portfolio effectively. By offering comprehensive features that simplify tracking, tax calculation, and reporting, CoinTracker addresses the needs of both novice and experienced crypto traders. In this section, we will discuss the core functionalities of CoinTracker and how it simplifies crypto management by integrating transactions across various platforms.

One of the most valuable benefits of CoinTracker is its ability to consolidate your entire cryptocurrency portfolio in one place. Regardless of whether you trade on multiple exchanges or use different wallets, CoinTracker automatically connects to these platforms and compiles your transaction history. This integrated approach not only offers a clear, holistic view of your assets but streamlines the tracking process, saving time and minimizing the risk of errors.

Here are some key features that make CoinTracker an exceptional choice for managing your cryptocurrency portfolio:

- Integration with leading crypto exchanges and wallets

- Automated tax calculations and report generation

- Real-time market data and customizable alerts

- Detailed portfolio performance insights and statistics

To further understand CoinTracker’s role in crypto management, let’s take a closer look at platform integrations.

Integration with Crypto Exchanges and Wallets

| Exchange/Wallet | Integration Type |

|---|---|

| Binance | API |

| Coinbase | API |

| Kraken | API |

| Bitfinex | API |

| MyEtherWallet | Public Address |

| Exodus Wallet | Public Address |

As seen in the table above, CoinTracker supports integration with popular exchanges and wallets, enabling you to import your transactions seamlessly. These integrations, combined with various other functionalities, position CoinTracker as a competitive solution for managing a diverse cryptocurrency portfolio.

How CoinTracker Simplifies Your Cryptocurrency Taxes

Managing cryptocurrency taxes can be a daunting task for many investors and traders, but CoinTracker streamlines the process by providing an efficient solution for crypto tax management. This section explores how CoinTracker’s dashboard, seamless integration with major exchanges and wallets, and tax report generation make handling cryptocurrency taxes much more accessible.

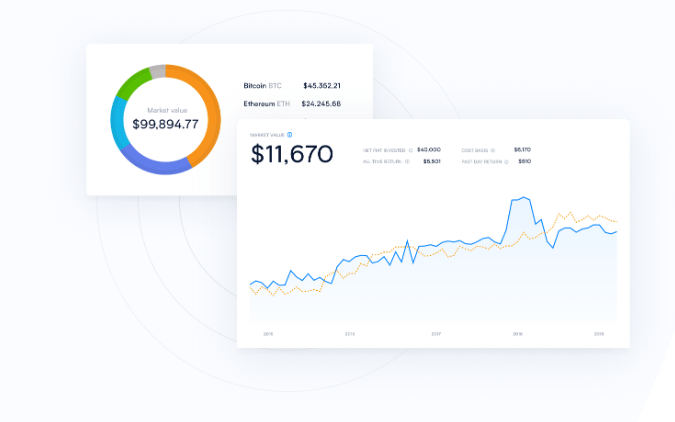

The CoinTracker Dashboard

The CoinTracker dashboard centralizes vital tax-related information, making it easy to navigate and understand at a glance. Users can find key metrics such as total gains, losses, and overall portfolio value, along with detailed transaction history, all in one place. As a result, the user-friendly interface enables you to monitor your crypto assets’ performance and tax implications effortlessly.

Integration with Major Exchanges and Wallets

CoinTracker integrates with most popular crypto exchanges and wallets, allowing users to sync their cryptocurrency transactions automatically. This feature eliminates the need for manual data entry and ensures accuracy in the tax calculation process. A comprehensive list of supported platforms includes:

- Binance

- Coinbase

- Kraken

- Bitstamp

- Hardware wallets like Ledger and Trezor

With wallet integration and exchange support, all transaction data is consolidated in one place, making it simple to track your cryptocurrency activities and taxes accurately.

CoinTracker’s Tax Report Generation

Generating crypto tax documents has never been easier, thanks to CoinTracker’s tax report generation feature. Users can generate a CoinTracker tax report by following these straightforward steps:

- Import transactions from all relevant exchanges and wallets.

- Review your transactions and make any necessary adjustments, such as identifying transfers between your wallets.

- Select the appropriate tax year and run the tax report, which calculates your gains, losses, and tax obligations compliant with the tax laws of your country.

- Download the tax report, which includes critical documents like IRS Form 8949 (for US users), for submission to your tax agency.

By streamlining tax report generation, CoinTracker saves both time and effort, making it easy to meet tax obligations while minimizing potential errors that can occur when handling cryptocurrency transactions manually.

Navigating CoinTracker Login and Account Setup

Setting up a CoinTracker account and logging in is a simple process that ensures you can start tracking your crypto taxes efficiently. Follow these steps for a smooth experience, from account setup to configuring tax tracking settings.

- Create an account: Visit the CoinTracker website and click on the “Get Started” button. You will be prompted to enter your email address and set up a strong password, following the guidelines provided.

- Verify your email: After signing up, check your email inbox for a verification email sent by CoinTracker. Click on the verification link provided to confirm your email address and activate your new account.

- Choose your plan: CoinTracker offers several pricing plans, ranging from a free version to premium tiers. Pick a suitable plan according to your transaction volume and desired features.

- Configure security settings: For increased security, enable two-factor authentication (2FA) to protect your account from unauthorized access. You can use authenticator apps such as Google Authenticator or Authy to generate the required authentication codes.

- Connect your wallets and exchanges: Upon successful account setup and login, navigate to the CoinTracker dashboard to begin integrating your crypto wallets and exchanges. This step is crucial for accurate crypto tax tracking.

- Set up your tax tracking preferences: Lastly, configure your tax tracking settings in accordance with your tax residence and applicable reporting requirements. You can specify parameters such as the tax year, cost basis method, and preferred currency for reporting.

By following these guidelines during the CoinTracker login and account setup process, you are ensuring a secure and organized platform for managing your crypto taxes. With a properly configured account, you can take full advantage of the features offered by CoinTracker to track and optimize your crypto tax obligations.

The Cost of Convenience: CoinTracker Pricing Explained

When evaluating CoinTracker as a potential solution for managing your cryptocurrency taxes, understanding the different pricing options available and what you can expect from each tier is crucial. CoinTracker offers various subscription plans to cater to the diverse needs of its users. Let’s delve into the details of each pricing tier and compare the features provided.

| Plan | No. of Transactions | Price | Features |

|---|---|---|---|

| Free | Up to 25 | $0 | Basic Portfolio TrackingIntegration with Major Exchanges and WalletsTax Calculations |

| Hobbyist | Up to 100 | $49 per year | All Free Plan FeaturesPriority SupportIncreased Transaction Limit |

| Pro | Up to 1,000 | $149 per year | All Hobbyist Plan FeaturesMargin Trading SupportIncreased Transaction Limit |

| High Volume Trader | Up to 3,000 | $499 per year | All Pro Plan FeaturesIncreased Transaction LimitPersonal Support |

| Unlimited | Unlimited | Contact CoinTracker | All High Volume Trader Plan FeaturesUnlimited TransactionsCustom Solutions |

As seen in the table, the CoinTracker subscription plans cater to a range of user requirements based on their transaction volume. The Free plan is ideal for individuals getting started with a limited number of transactions, whereas the Hobbyist, Pro, and High Volume Trader plans are more suitable for seasoned crypto investors with higher transaction volumes and greater complexity in their portfolios. For users with an extensive number of transactions and customized needs, the Unlimited plan offers tailored solutions. When deciding on a CoinTracker subscription, it’s essential to weigh the crypto tax software cost against the features and support offered in each plan to ensure you select the most cost-effective and practical option for your unique needs.

Mobile Tracking on the Go: CoinTracker App Overview

In today’s fast-paced world, having access to your cryptocurrency portfolio and tax information on the go is essential. The CoinTracker app is designed to provide a seamless experience for users who want to stay connected to their crypto assets anytime, anywhere. In this section, we will take a closer look at the CoinTracker app, its features, and how it facilitates mobile crypto tracking with ease.

Functionality and Design

The CoinTracker app is designed with a user-friendly interface, making it easy to navigate and access the essential features. Maintaining the same core functionalities present on the web-based platform, the app enables users to:

- Monitor their cryptocurrency portfolio

- Access the value of their holdings in real-time

- Track transactions across multiple platforms

- Generate tax reports

- Receive notifications and alerts

The app is optimized for both iOS and Android devices, ensuring accessibility for a variety of users. Just like the web version, the cryptocurrency app prioritizes data security and privacy, making it a reliable tool for portfolio and tax management.

Complementing the Web-Based Platform Experience

One of the main advantages of the CoinTracker app is its compatibility with the web-based platform. The seamless integration ensures that your data remains updated and consistent across both platforms. This allows you to make informed decisions based on accurate information, regardless of your preferred device.

For example, if you add new transactions or import data from your preferred exchange while using the web-based platform, these changes will be automatically updated on the app, and vice versa.

To ensure maximum benefit from the mobile tracking experience, consider setting up customized alerts and notifications within the app. Configuring these alerts enables you to stay informed of market trends or significant changes in your portfolio, even when you’re away from your computer.

In conclusion, the CoinTracker app is an excellent complement to the web-based platform, making it easier for users to stay connected to their cryptocurrency portfolio, taxes, and market news. By offering a user-friendly design and seamless integration with the web-based experience, the CoinTracker app is a valuable tool for mobile crypto tracking.

An In-Depth Look at CoinTracker Features

Managing a diverse cryptocurrency portfolio can be complex, but CoinTracker simplifies the process by offering a robust set of features that cater to the different needs of crypto investors. In this section, we will explore CoinTracker’s comprehensive portfolio tracking capabilities and real-time market data and alerts.

Create an image of a digital wallet with various types of cryptocurrency, including bitcoin, ethereum, and litecoin. Show the user interface of the CoinTracker app, highlighting its features such as real-time price tracking, portfolio management, tax reporting, and transaction history. Add a sleek and modern design to convey the high-tech nature of the cryptocurrency industry.

Portfolio Tracking Across Multiple Platforms

One of the standout aspects of CoinTracker is its ability to track crypto portfolios across various platforms seamlessly. With support for over 300 exchanges and multiple blockchains, users can benefit from a consolidated view of their assets. This extensive coverage enables users to efficiently manage their digital currency investments, regardless of whether they operate from a single exchange or multiple platforms.

Some key features of CoinTracker’s platform-wide portfolio tracking include:

- Automatic import of transactions from popular exchanges through API integration

- Manual entry of transactions for unsupported platforms

- Compatibility with hardware wallets, mobile wallets, and other digital currency platforms

- Accurate calculation of profit and loss data from multiple sources

- Historical portfolio performance, cost basis, and balances analysis

Real-Time Market Data & Alerts

Staying up-to-date with market trends and fluctuations is crucial when investing in the volatile cryptocurrency markets. CoinTracker provides you with valuable real-time market data insights and customizable crypto alerts. This vital feature not only keeps users informed but also helps them make better investment decisions based on market insights.

Here are some of the benefits of CoinTracker’s real-time market data and alerts:

- Access to real-time price data for various cryptocurrencies, allowing for informed decision-making

- Customizable alerts to notify users of significant price movements or when specific market thresholds are reached

- Market analysis to identify emerging trends and patterns across different cryptocurrencies and platforms

- Performance comparison between individual crypto assets and broader market indices

- An easy-to-use interface that presents all relevant market data in a clear and concise manner

A well-rounded cryptocurrency portfolio management tool is essential for maximizing returns and minimizing risks. With CoinTracker’s comprehensive portfolio tracking across multiple platforms and real-time market data insights, users can confidently navigate the ever-changing crypto landscape.

Security Measures: How Safe Is CoinTracker?

When it comes to managing your cryptocurrency assets and taxes, the importance of security cannot be overstated. CoinTracker security prioritizes the protection of users’ financial data and privacy. In this section, we’ll explore the measures taken by CoinTracker to ensure a safe and secure environment for its users while tracking their crypto assets and generating tax reports.

Data Encryption and Secure Communication

CoinTracker uses state-of-the-art encryption techniques to protect sensitive user data. All data transmitted between the user’s devices and CoinTracker’s servers is encrypted using SSL/TLS. This ensures that your data remains private and secure while being transmitted across the internet. Additionally, CoinTracker stores user data in a secure and encrypted format to protect against unauthorized access or data breaches.

API Key Management and Limited Access

One of the primary aspects of crypto tracking security is the proper management of API keys. CoinTracker achieves this by requiring read-only API keys when connecting your crypto exchange accounts. This limits the access granted to CoinTracker and prevents any potential unauthorized transactions. Furthermore, CoinTracker does not support withdrawal capabilities, adding an extra layer of security to your connected accounts.

Two-Factor Authentication

As a safe crypto tax software, CoinTracker allows you to enable two-factor authentication (2FA) for your account. 2FA adds an additional layer of security by requiring users to provide a unique, time-sensitive code generated by an authenticator app on their mobile devices in addition to their account password. By using 2FA, the chance of unauthorized access to your CoinTracker account is significantly decreased.

- Data Encryption and Secure Communication

- API Key Management and Limited Access

- Two-Factor Authentication

Privacy and Data Retention

CoinTracker adheres to strict privacy guidelines and does not sell or share user data with any third parties. The platform only retains user data for as long as is necessary to provide its services or meet its legal obligations. CoinTracker’s data retention policy ensures that your data is deleted when it is no longer needed.

As this overview shows, CoinTracker implements multiple protective measures and follows best practices to maintain a high level of safety and security for its users. By encrypting sensitive data, requiring read-only API keys, offering 2FA, and respecting user privacy, CoinTracker proves itself as a secure and reliable crypto tax tracking platform.

Cointrackerio’s Customer Support and User Community

As a user of CoinTracker, it’s essential to have access to reliable customer support when dealing with complex cryptocurrency tax situations. Cointrackerio customer support strives to provide quality assistance for troubleshooting and resolving various tax-related matters. Additionally, the CoinTracker community offers valuable peer support, which can enhance your understanding and provide solutions to common user challenges.

An essential aspect of quality customer support is accessibility. Cointrackerio customer support can be reached through their support page, where users can submit support requests. This ensures a streamlined process for addressing your concerns and obtaining personalized assistance.

Beyond the official support channels, another invaluable resource for CoinTracker users is the CoinTracker community. This active user forum acts as an excellent support system where members can exchange ideas, share solutions, and learn from each other’s experiences. This camaraderie encourages collaborative problem-solving and fosters a sense of belonging for cryptocurrency enthusiasts using CoinTracker.

- Availability of dedicated and responsive customer support

- Access to a vibrant and engaging user community

- Efficient resolution of user issues and inquiries

- Peer support for learning and sharing experiences

- Opportunities for networking and knowledge sharing within the community

Overall, Cointrackerio customer support and the CoinTracker community are instrumental in ensuring a smooth and seamless experience for users. By actively participating in the community and seeking assistance when needed, users can make the most out of CoinTracker’s features and gain valuable insights for managing their cryptocurrency portfolios.

CoinTracker Free vs. Premium: Which is Right for You?

When deciding between the CoinTracker free version and the various CoinTracker premium plans, there are several factors to consider. In this section, we’ll explore the limitations of the free version as well as the added benefits that come with the premium plans, helping you decide which option best suits your unique cryptocurrency investment tracking needs.

Create an image of two coins, one labeled “Free” and the other labeled “Premium,” side-by-side on a balance scale. The Free coin should be smaller or lighter than the Premium coin to represent the difference in features and benefits between the two versions of CoinTracker. The background should be a gradient of blue and green to symbolize financial growth and stability.

The Limitations of CoinTracker Free Version

While the CoinTracker free version serves as a useful starting point for new investors or those with minimal transactions, it comes with certain limitations that may make it less effective for larger-scale operations:

- Limited transaction tracking: CoinTracker Free supports only up to 25 transactions, which may be insufficient for active crypto investors.

- Basic tax reports: Free users have access to only capital gains summary reports, not the full suite of tax reports provided in the premium plans.

- No priority support: CoinTracker free users do not receive priority customer support assistance in case of any issues or queries.

These constraints make the free version of CoinTracker a viable starter option for users looking for a simple crypto tax tool to manage their relatively small-scale investments. However, for more robust tax management and advanced features, upgrading to a CoinTracker premium plan may be necessary.

Benefits of Upgrading to CoinTracker Premium

For users seeking enhanced crypto investment tracking, the CoinTracker premium plans offer an extensive range of advanced features and benefits. Upgrading to one of these plans enables access to:

- Increased transaction limits: Premium plans support higher transaction volumes, ranging from 100 to 10,000 transactions – ideal for more seasoned crypto investors.

- Comprehensive tax reports: In addition to capital gains summaries, premium users receive detailed tax reports, including Form 8949, schedule D, and international tax reports where applicable.

- Wallet and exchange data import: Allow for seamless integration of wallet and exchange data, ensuring all transactions are accurately tracked and reported.

- Priority support: Faster response times from customer support, ensuring a smoother and more efficient user experience.

Ultimately, the decision to upgrade to a CoinTracker premium plan will depend on the complexity and volume of your cryptocurrency investments. If you have a higher number of transactions or require advanced reporting features and priority support, a premium plan could be the right choice for you. On the other hand, if your crypto investment activity is limited and a basic tax tool is sufficient, the CoinTracker free version may be all you need.

User Experience and Interface: Navigating CoinTracker Review

CoinTracker interface plays a pivotal role in enhancing user experience and making the platform accessible to both beginners and experienced crypto investors. This section aims to provide an in-depth appraisal of CoinTracker interface design, which contributes to its usability and overall performance.

At its core, the CoinTracker user experience is defined by clean design, user-friendly navigation, and logical structuring of its features. Users can easily access critical sections, such as Dashboard, Wallets, and Tax Reports, via the main navigation bar at the top of the page.

Within each section, the interface presents relevant information using panels and tables that allow for an organized and clutter-free presentation. When it comes to simplifying complex tax reporting processes, this layout proves invaluable.

Now let’s delve into some of the specific components of the CoinTracker interface and how they contribute to platform usability:

- Dashboard: The dashboard presents an overview of your entire cryptocurrency portfolio, including total asset value and performance analytics. It utilizes charts and visual representations to make data easy to digest and analyze at a glance.

- Wallets & Exchanges: CoinTracker allows users to easily add wallets and exchange accounts from a wide array of supported platforms. This integration streamlines the aggregation of transaction history and other data required for tax reporting.

- Tax Reports: Generating tax reports is made simple through the platform’s cohesive and step-by-step process. Users are guided through connecting wallets, importing transactions, and tax calculations to produce comprehensive tax reports.

- Alerts & Notifications: Real-time alerts and notifications are easily accessible within the main interface, allowing users to stay informed about vital market trends and portfolio changes.

To further illustrate the usability of CoinTracker, let’s explore some of its features in a table to showcase comparative aspects:

| Feature | Brief Description | Usability Impact |

|---|---|---|

| Portfolio Dashboard | Displays an overview of your entire cryptocurrency portfolio and its performance. | Highly accessible and easy to understand for users of all levels. |

| Wallets & Exchanges Integration | Syncing of wallets and exchanges for a comprehensive transaction history. | Simplifies data aggregation and reduces manual input errors. |

| Tax Reports | A step-by-step guided process for generating accurate tax reports. | Streamlines tax reporting and ensures compliance with regulatory requirements. |

| Alerts & Notifications | User-customizable alerts for market trends and portfolio changes. | Keeps users informed and prepared for market fluctuations. |

In conclusion, CoinTracker has crafted an interface that is both intuitive and visually appealing, ensuring a positive user experience for those managing their crypto assets and taxes. The platform’s design demonstrates a strong commitment to usability, catering to users at all levels of expertise in the cryptocurrency industry.

Best Crypto Coin Tracking App Alternatives to CoinTracker

While CoinTracker offers an impressive range of features for crypto tracking and tax management, you may have different preferences or needs that are better served by other platforms. Comparing alternatives can help you determine which solution aligns best with your requirements, particularly regarding features, pricing, and user feedback.

Why Consider Alternatives?

Some reasons to consider alternatives to CoinTracker include:

- Different pricing structures that fit your budget

- Specific features not present in CoinTracker

- Preferable user interfaces and experiences

- Higher-rated customer support or user communities

Exploring the competitive landscape of crypto tax software options, here’s a comprehensive comparison of the best CoinTracker alternatives.

Comparing Features, Pricing, and User Feedback

| Platform | Key Features | Pricing | User Feedback |

|---|---|---|---|

| Accointing | Integrates with 300+ exchanges and walletsMobile appCustomizable alertsReal-time data insights | Free plan availablePro plan: $149.99/yearAdvanced plan: $399.99/year | Highly rated on customer reviews based on ease of use and seamless integrations; responsive customer support |

| Koinly | Integrations with 300+ exchanges, wallets, and blockchainsIncludes over 6,000 cryptocurrenciesAPI support for importing dataSupports tax form generations for multiple countries | Free plan availableHodler plan: $99/yearTrader plan: $179/yearOracle plan: $279/year | Positive user reviews for quick tax report generation and easy setup process; some complaints regarding data import and customer support |

| CryptoTrader.Tax | Integration with major exchangesAutomated tax form generationData import through APITurboTax integration | One-time fee per tax yearRanging from $49 to $299, based on transaction volume | Positive user reviews focused on ease of use, comprehensive features, and quick tax report generation; occasional issues reported with data import |

| ZenLedger | Automated tax form generationLoss harvesting analysisExcel and API integrationCustomizable dashboard | Free plan availableAdvanced plans range from $69 to $799/year | Mostly positive user feedback regarding intuitive interface, fast customer support, and efficient tax report generation; some complaints on data import accuracy |

When searching for CoinTracker alternatives, it’s essential to evaluate each platform’s features, pricing, and user feedback thoroughly. This will help you confidently choose a crypto tax software solution tailored to your specific needs and preferences.

Exploring Crypto Tax Calculator Options Beyond CoinTracker

While CoinTracker is a popular choice for managing cryptocurrency taxes, it’s essential to consider other crypto tax calculation tools available on the market. By exploring CoinTracker alternatives, you can find a solution that better caters to your specific needs and tax situations. In this section, we will introduce three alternative tax calculation tools for cryptocurrency investors to consider.

A visual representation of a roadmap with arrows pointing to different directions, each labeled with a different crypto tax calculator alternative. Some arrows are longer or shorter than others, and some have more traffic flowing towards them. The background consists of various abstract shapes in shades of blue and green, symbolizing the complexity and diversity of the crypto tax calculator market.

1. Koinly

Koinly is a well-known alternative to CoinTracker, offering a comprehensive platform for cryptocurrency tax management. Some of its standout features include:

- Integration with over 300 exchanges and wallets

- Support for more than 50 countries and various tax systems

- Customizable capital gains calculations based on local tax laws

- Tax report generation in multiple formats

2. CryptoTrader.Tax

CryptoTrader.Tax is another popular alternative, focusing solely on crypto tax calculation. Key features of CryptoTrader.Tax include:

- User-friendly import options for transaction data

- Compatibility with major tax software like TurboTax and TaxAct

- Multiple pricing tiers, catering to different investor profiles

- Support for international tax jurisdictions

3. TokenTax

TokenTax is a versatile crypto tax calculator solution, offering unique features tailored for various crypto users. Some notable highlights of TokenTax are:

- Integration with all major wallets and exchanges

- Automatic crypto-to-crypto conversion for accurate tax calculations

- Customized tax planning for DeFi and margin trading activities

- Dedicated tax consultation services

| Crypto Tax Calculator | Integration with Exchanges & Wallets | International Support | Unique Features |

|---|---|---|---|

| Koinly | Over 300 exchanges and wallets | 50+ countries and various tax systems | Customizable capital gains calculations |

| CryptoTrader.Tax | Major exchanges and wallets | Multiple international tax jurisdictions | Compatibility with TurboTax and TaxAct |

| TokenTax | All major wallets and exchanges | Yes | Tax planning for DeFi and margin trading |

When evaluating crypto tax calculator options, it’s important to carefully consider factors such as user experience, integration capabilities, pricing, and international support. By assessing the features and benefits of each CoinTracker alternative, you can make an informed decision on which crypto tax calculation tool best fits your unique requirements and tax situation.

Several platforms offer a more extensive range of services:

- Portfolio tracking and synchronization

- Historical performance analysis

- Real-time market data and customizable alerts

- Automated or scheduled trading on multiple exchanges

- Advanced trading tools and order types

- Integration with hardware wallets and mobile applications

Let us delve deeper into three noteworthy examples of platforms that offer comprehensive cryptocurrency portfolio management:

| Platform | Services Offered |

|---|---|

| Blockfolio | Real-time market data and price alertsAutomated tracking of crypto investments across multiple exchangesSeamless integration with hardware wallets and mobile devices |

| Delta Investment Tracker | Comprehensive portfolio tracking with support for over 9,000 assetsAdvanced trading tools and analyticsSync with multiple exchanges and wallets for accurate record-keeping |

| Altrady | Unified interface for trading on multiple exchangesCustomizable trading workspace and dashboardAdvanced order types and trading strategies |

While CoinTracker offers robust tax reporting and portfolio tracking features, it might not satisfy every user’s demands for comprehensive portfolio management. Considering platforms like Blockfolio, Delta Investment Tracker, and Altrady expands your options, helping you find a tailor-made solution that fits your investment strategy, monitoring preferences, and overall goals in the world of cryptocurrency. Make an informed decision when choosing the best platform by comparing features, pricing, user reviews, and overall compatibility with your unique needs and objectives.

Personalized Bit Coin Tracking: Tailoring the Experience

When it comes to managing your cryptocurrency investments, personalized bit coin tracking can make all the difference. The dynamic nature of digital currencies, combined with the unique strategies and goals of each investor, demands a tailored tracking solution to accommodate these various factors. Custom crypto tracking platforms enable you to keep a close watch on your cryptocurrency portfolio by offering essential features and insights tailored to your specific requirements.

- Customized alerts and notifications for price movements and market trends

- Integration with multiple crypto exchanges and wallets to track transactions across various platforms

- Real-time portfolio performance monitoring with user-friendly interface

- Personalized tax reporting as per your jurisdiction’s regulations

Choosing a custom crypto tracking solution that caters to your individual needs can lead to a more accurate and insightful assessment of your investments. The ideal bit coin tracker should offer a well-rounded experience that allows you to optimize your investment strategy as you monitor the dynamic cryptocurrency market.

| Platform | Customizable Alerts | Multiple Wallets & Exchanges Integration | |

|---|---|---|---|

| CoinTracker | Yes | Yes | Yes |

| Koinly | Yes | Yes | Yes |

| Blockfolio | Yes | Yes | No |

| Yes | Yes | No |

In conclusion, personalized bit coin tracking is essential for catering to the distinct requirements of individual investors. Custom crypto tracking platforms can significantly enhance your cryptocurrency investment experience by providing insights and tools tailored to your unique strategies and goals. When selecting a tailored bit coin tracker, consider the features and integrations that best align with your requirements to ensure you make the most informed decisions possible.

Conclusion

After a thorough CoinTracker review, it’s clear that this platform offers an exceptional approach to crypto management and tax reporting. With a range of features, including comprehensive portfolio tracking and integration with top wallets and exchanges, CoinTracker simplifies the complex process of handling cryptocurrency taxes.

The detailed analysis provided in this article showcases the power and value of CoinTracker’s tools, as well as its user-friendly interface and robust security measures. However, it’s important to keep in mind that individual needs and preferences may vary. In such cases, alternative bit coin trackers and tax calculators may serve better.

In summary, CoinTracker stands out among its peers in the crypto management landscape, making it a top choice for investors and traders alike. Before making your decision, take the time to consider your unique requirements and weigh the benefits and drawbacks of each option. Your cryptocurrency journey will be more rewarding with the right tools at your disposal.

FAQ

What is CoinTracker?

CoinTracker is a cryptocurrency portfolio management and tax calculation platform designed to streamline tracking, tax reporting, and provide in-depth insights into your cryptocurrency investments. It integrates with major exchanges and wallets to consolidate all transaction data and generate accurate tax reports for users.

Can I use CoinTracker for free?

Yes, CoinTracker offers a free version with basic functionalities and limited transactions. However, to access more advanced features, increased transaction limits, and personalized support, you may need to upgrade to a paid subscription plan.

How does CoinTracker simplify cryptocurrency tax calculation?

CoinTracker connects to your wallets and exchanges, imports your transactions, and automatically calculates your cryptocurrency taxable gains and losses. It generates ready-to-use tax reports that can be easily imported into tax filing software or shared with your accountant.

Is the CoinTracker app available on mobile?

Yes, CoinTracker offers a mobile app for both iOS and Android devices, allowing you to manage and track your cryptocurrency portfolio and taxes on the go.

How secure is my data on CoinTracker?

CoinTracker employs advanced security measures to protect your data and privacy, including encryption, periodic security audits, and limiting access to sensitive information. Their commitment to user security ensures the safety of your financial data.

Are there any alternatives to CoinTracker?

Yes, there are several alternatives to CoinTracker, including crypto tax calculators and portfolio trackers with differing features, pricing, and interfaces. Researching and comparing these tools can help you find the best fit for your unique portfolio management and tax calculation needs.

How do I get started with CoinTracker?

To get started with CoinTracker, visit their website, create an account, and follow the steps to connect your wallets and exchanges. This will allow the platform to import your transactions and provide you with comprehensive portfolio management and tax calculation features.

Can I customize alert notifications on CoinTracker?

Yes, CoinTracker allows you to customize alerts for price movements, market trends, and other relevant information to help you stay updated on the cryptocurrency market and make informed investment decisions.

What types of customer support are available for CoinTracker users?

CoinTracker offers customer support through email and an extensive help center filled with useful articles, guides, and video tutorials. Additionally, there is an active user community to provide peer support and exchange experiences related to tracking, management, and taxation of cryptocurrencies.