Crypto Taxes Sorted

At Recap, they have created a powerful portfolio manager for Bitcoin and all cryptocurrencies that automatically calculates your crypto tax position.

Recap Review And Best Alternatives

Calculating your crypto taxes can be very difficult to do, especially if you’re trading daily and have many positions. But fortunately, many crypto tax calculators automate the job. And for that reason, we decided to review Recap.

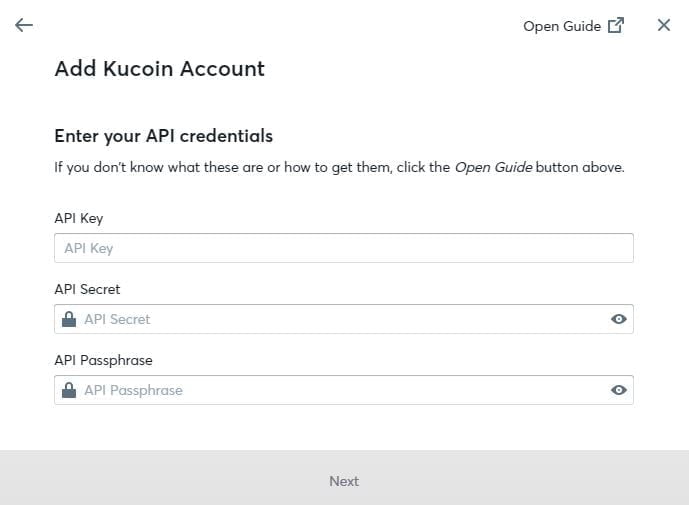

Crypto tax calculators and Recap connect to your exchange through an API key or to your wallet by entering your wallet’s address. Afterward, platforms retrieve data from your exchange/wallet regarding all closed orders and transactions. Following that, the system calculates your taxes according to the tax report you’ve selected and fills it.

During this post, we’re highlighting Recap and demonstrating all of its features and functions. Also, we’re willing to explain how you can connect your exchange to Recap and use its features, so let’s get to it.

About Recap.

Recap creates a robust portfolio manager for Bitcoin and all cryptocurrencies that also automatically calculates your crypto tax position with no human error.

Also Read: Best Crypto Tax Softwares & Calculators.

Recap Features.

As mentioned, Recap has different features to ease the process further. In the following part, we’ll review Recap features and functions.

Real-Time Connection.

Considering how live data is, you’ll get a real-time and direct connection to your exchange. Hence, you can view your transactions and see their impact on your taxes immediately.

Different Ways of Input.

Recap supports different ways to input your transaction data, like manual and CSV inputs. If your exchange isn’t supported or operating anymore, there’ll be no problem inputting your data.

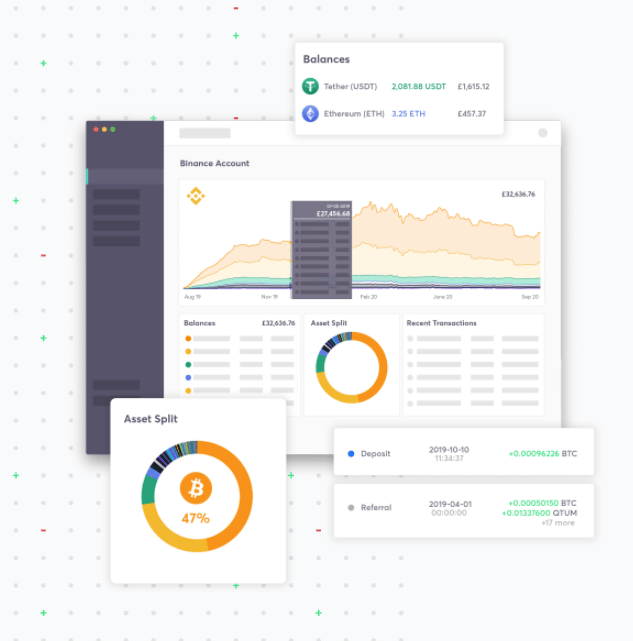

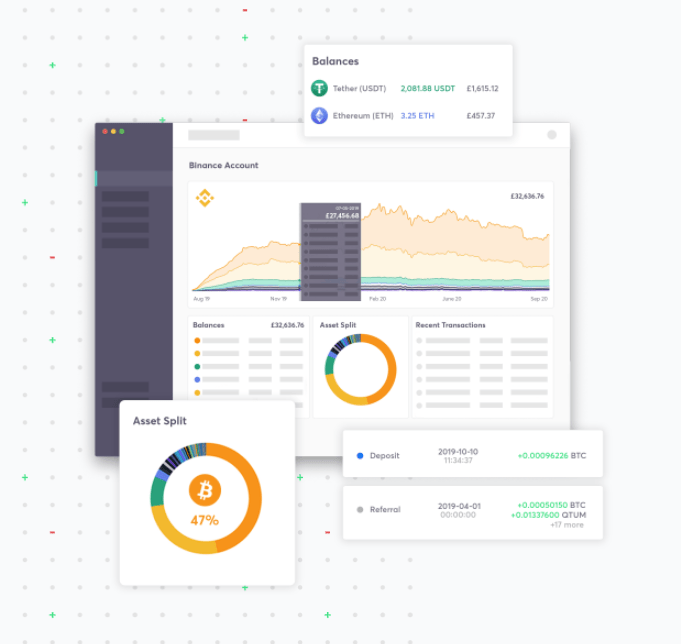

Overview Your Portfolio.

Just like automated trading platforms, you can view your holdings and see how you’ve been doing lately. Furthermore, you can understand the proportion of your account value stored in each asset, allowing you to make investment or rebalancing decisions.

Supported Exchanges.

Of course, as a big crypto tax calculator, Recap supports major exchanges, including Binance, Kraken, Bitfinex, and more.

FAQ.

Is Recap Safe to Use?

Yes, as your exchange is connected to Recap through API keys; further, you’re the one who controls permissions granted within each API key. Also, your connection to Recap is one-side-encrypted, so only you can view information.

Is Recap Easy?

Recap is simple and straightforward; you can generate your tax reports after connecting your exchange. And later on, we’re demonstrating how you can do all of that.

Which Countries Are Supported?

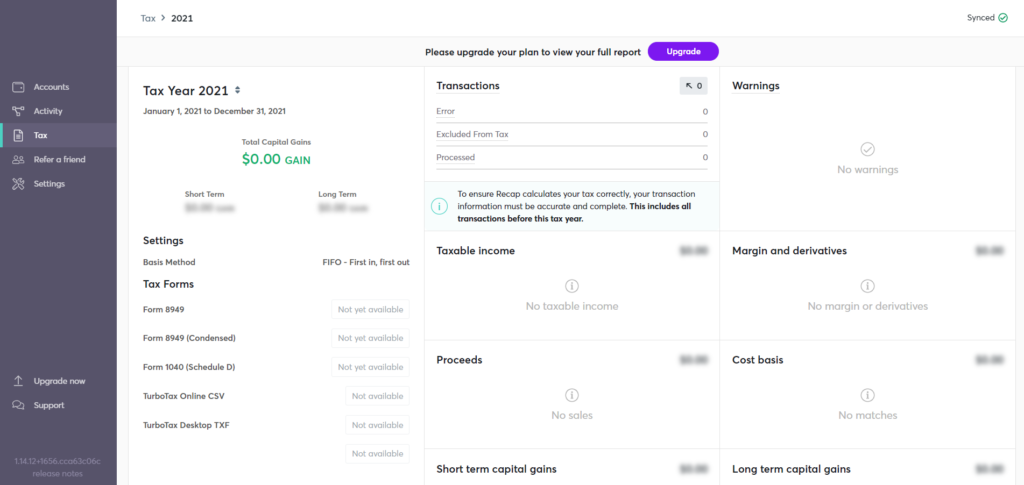

Recap localizes reports for the USA and UK. But also, if your country uses FIFO, LIFO, Highest Cost, Lowest Cost, Recap can calculate your taxes too.

Is Recap’s Extension Safe? and What Does It Do?

Recap’s extension adds further security to the system. It directly connects to your exchange and calculates your taxes, as your information is never exposed to Recap’s servers.

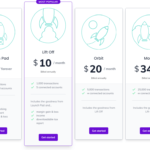

What Are Recap Plans?

Recap has very reasonable plans. Starting at $10~$34 billed monthly plus a free plan.

Starting with Recap.

In the following part of our Recap review, we will illustrate how you can start on Recap by connecting your exchange and generating your tax reports.

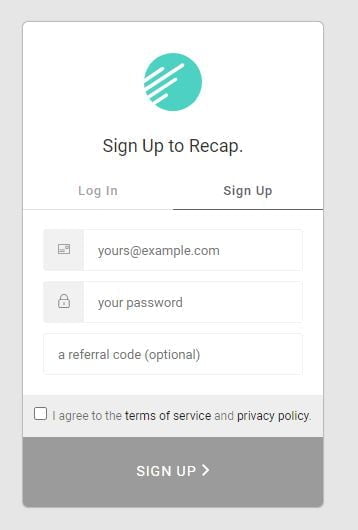

Sign-up at Recap.

Firstly, use this invitation link to get a 20% discount, submit your information, and click on sign-up.

Verify Your Account.

After submitting your information, visit your email and look for a Recap team verification link to confirm your account.

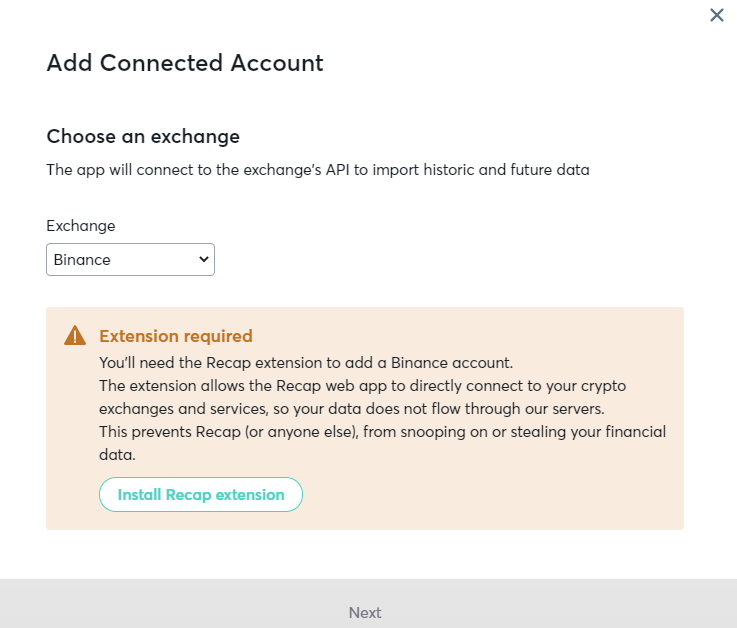

Install Recap Extension.

To ensure a secure connection between you and Recap, you need to install Recap’s extension on your browser. After clicking on ‘Add Account’, Click on ‘Install Recap Extension’.

Because your connection to Recap is one-side-encrypted, you need Recap’s extension to calculate your taxes. It directly connects to your crypto exchange, and your data never goes to Recap’s servers. Meaning all your financial data will remain safe.

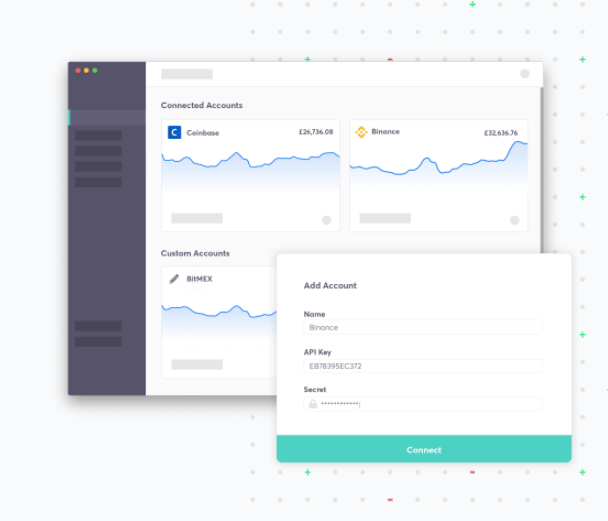

Connect Your Exchange.

Finally, click on ‘Add Account’ on the main page, select your exchange, and enter your API key.

Generate Your Tax Report.

Now, on Recap’s main page, click ‘Tax’ on the left menu to overview your taxes and generate the report you want.

Conclusion.

During our Recap review, we found what we were looking for, and you’ll as well. However, there are some things that we didn’t like about Recap. So here is our Recap pros and cons list.

Pros.

- Easy to use

- CSV and Manual inputs

- Supports major exchanges.

Cons.

- It doesn’t support wallets.

- Not many reports are supported.