Bitcoin and Crypto Taxes for Capital Gains and Income

One of the leading capital gains and income tax calculator for Bitcoin, Ethereum, Ripple, and other digital currencies. Bitcoin Taxes has provided services to consumers and tax professionals since its launch in 2014.

BitcoinTaxes Review And Best Alternatives

Since crypto and Bitcoin started gaining popularity and value, authorities have started taxing it. Calculating your taxes itself isn’t such a hard job, but imagine pulling all your transactional data from different exchanges for different currencies at the end of each tax year; that’s not so easy. However, the process can be automated using simple software. In this post, we’ll review Bitcoin.tax and teach you how to automate crypto taxing calculations easily.

Before starting with Bitcoin.tax, we will first consider how crypto tax calculators work in general. After you have connected your exchange to a crypto calculator through an API key, the system starts retrieving all of your transactional data, coins, value, etc. After that, the magic takes place, and you can download various types of reports within a few moments. Bitcoin.tax works the same way. Let’s get to it.

About Bitcoin.tax

Bitcoin.tax is the leading capital gains and income tax calculator for Bitcoin, Ethereum, Ripple, and other digital currencies. Bitcoin.tax has provided services to consumers and tax professionals since its launch in 2014.

Also Read: CoinTracking Review and Best Alternatives.

BitcoinTax Features

In the following part of our Bitcoin.tax review, we’re explaining all of the platform’s features and functions so you get an overview of the Bitcoin.tax experience.

Full Tax Preparation Service

BitcoinTax provides a full tax preparation service in partnership with tax attorneys, CPAs, and enrolled agents. Also, Bitcoin.tax users can get tax preparation, advice, and planning with a crypto tax professional to complete and file their tax returns.

Audit Defense Service

Bitcoin.tax partners with tax attorneys to provide Bitcoin.tax users with an audit defense service in case of an opened IRS audit for one or more tax years.

Bitcoin.tax can:

- Serve as your representative before the IRS to resolve your case

- Respond to IRS letters, e.g., CP2000, providing more information

- Respond to IRS audits for one or more tax years

- Reconcile missing or unreported transactions

- Respond to Criminal Investigation (CI) for interview or subpoena

- Provide defense against potential federal crimes, including tax or money laundering

- Represent you and coordinate with federal law enforcement agents in your defense

Online Tax Preparation Services

Because Bitcoin.tax works with TurboTax, you can import your tax reports from Bitcoin.tax directly into TurboTax for further processing.

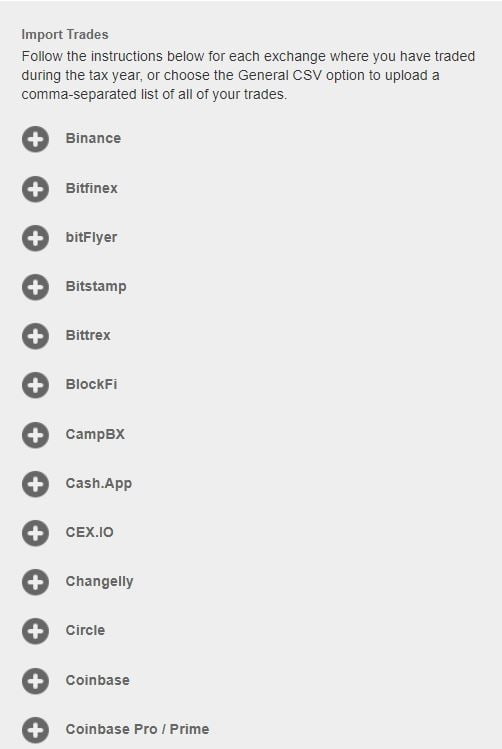

Supported Exchanges

Bitcoin.tax supports various major exchanges. Here’s a list:

- Binance

- Bitfinex

- bitFlyer

- Bitstamp

- Bittrex

- BTC-e / WEX

- CampBX

- CEX.IO

- Circle

- Coinbase

- Coinbase Pro / GDAX

- Cryptopia

- Gemini

- HitBTC

- Kraken

- KuCoin

- LocalBitcoins

- Paxful

- Poloniex

- Uphold

- VirWox

Also, data can be imported using a specifically formatted CSV or manual entering in case support for your exchange isn’t built-in.

FAQ

Is Bitcoin.tax Easy to Use?

Yes. During our Bitcoin.tax review, we had no problems getting started with the platform. Everything was categorized in tabs and clearly explained.

Is Bitcoin.tax Safe?

Of course, Bitcoin.tax is safe because your exchange is connected through API keys, and you can always change API’s permissions. Also, you can always choose to import your data through CSV files. Further, Bitcoin.tax uses encryption.

What Reports Does Bitcoin.tax Support?

Bitcoin.tax supports the following reports:

Gains and losses report as CSV, Schedule D 8949 PDF, 8949 attachable statement, Various TurboTax formats.

Also, you can choose from the following accounting methods:

FIFO, LIFO, Pooling, with same-day and 30-day rules (United Kingdom), Adjusted cost basis and superficial losses (Canada)

What Are Bitcoin.tax’s Plans?

Bitcoin.tax has over 15 different plans for traders with various needs. There’s a free plan and paid plans starting at $39.59 and rising as high as $2,000.00 per month.

Starting with Bitcoin.tax

In the following part of our Bitcoin.tax review, you’ll learn how to generate a tax report on Bitcoin.tax. In fact, it’s a simple process and will take you only a few moments.

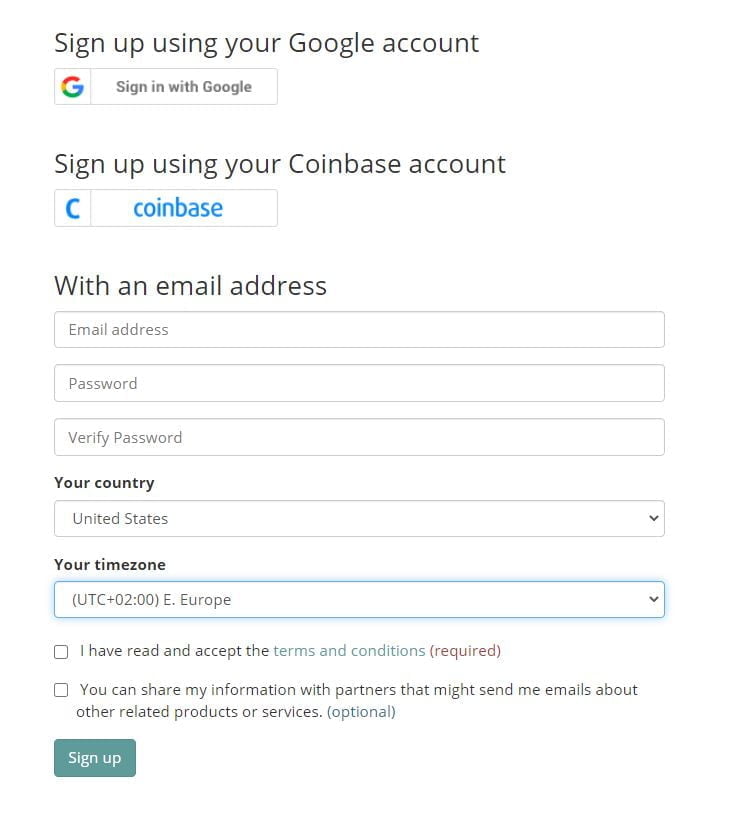

Creating an Account

Firstly, visit Bitcoin.tax’s main page and click on ‘Sign up’ in the top right. After that, submit your information, and you can also proceed with Google or Coinbase.

Verifying Your Account

Once you’ve signed up, visit your email and look for an email from Bitcoin.tax’s team that includes a verification link.

Connecting Your Exchange

On the right. Click on the ‘+’ icon, and then you can choose to connect your exchange via API keys or proceed with CSV files.

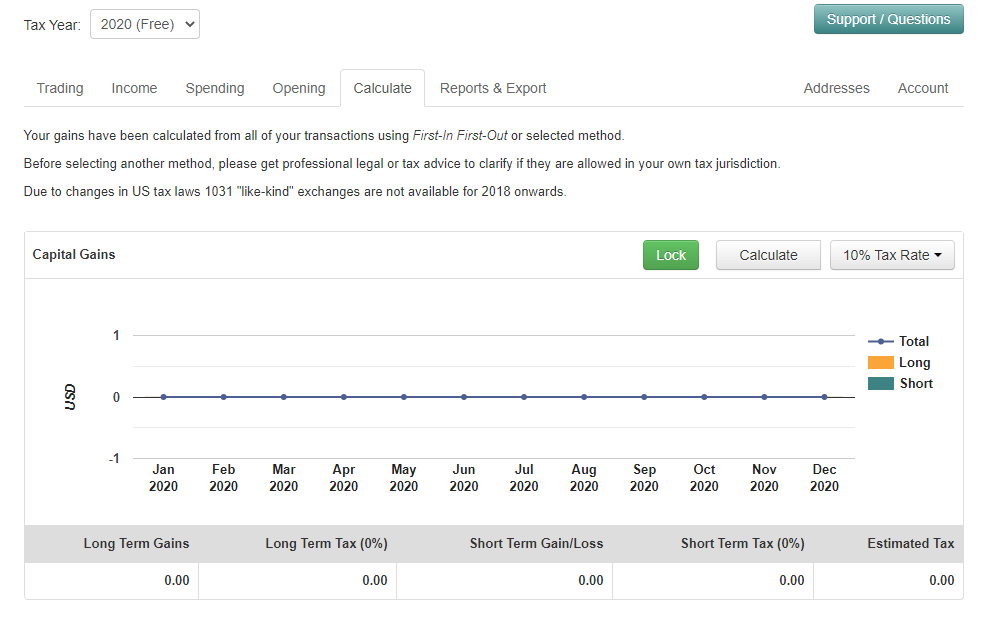

Generate a Report

Before generating your first tax report, you need to calculate your gains/losses. Go to the ‘Calculate’ tab and choose your tax year then click on ‘Calculate.’

Finally, go to ‘Reports & Export’ and choose the report you’d like to download. Congratulations, you’ve just calculated your crypto taxes with only two steps.

Conclusion

There’s no doubt that Bitcoin.tax has many different features to offer and is considered one of the best tax calculators for crypto. Furthermore, its integration with TurboTax makes up for some of the cons that we’ve found during our Bitcoin.tax review. More in Bitcoin.tax pros and cons.

Pros

- Simple to use

- TurboTax and TaxAct “Direct Import”

- Supports major exchanges

Cons

- Primitive UI

- No mobile compatibility.