Portfoliotracking und Steuern in Minuten

Blockpit has been dealing with the topic of compliance with cryptocurrencies. They have developed a software platform that combines all crypto sources to simplify processes resulting from complex regulations and tax laws.

Blockpit Review And Best Alternatives

In this article: Blockpit review, we’re introducing Blockpit as one of the best tax calculators for traders and miners.

There’s no doubt that filing tax reports is undoubtedly tedious and challenging, especially for traders and miners. Filling tax reports is an annual action. However, it still takes a lot of time, preparation, and paperwork. Also, it would help to consider taxes before making trades to minimize your taxes.

For that matter, there are many platforms that perform tax calculations, and reports automatically for traders and miners, And Blockpit is one of the best. This article highlights Blockpit, reviews its functions and features, and illustrates how to start on it.

About Blockpit.

Blockpit has been dealing with the topic of compliance with cryptocurrencies. Also, they have developed a software platform that combines all crypto sources to simplify processes resulting from complex regulations and tax laws.

Also Read: Best Crypto Tax Softwares & Calculators .

Blockpit Features.

Blockpit offers a comprehensive array of features that streamline and simplify the often complex tax filing and reporting process. Beyond its core functionality, Blockpit continues to unveil many additional features, which we’ll delve into further as we explore this Blockpit review.

Portfolio Management.

After connecting your exchange/wallet, you’ll get an overview of your holdings so you can take a look at how you have been doing overall.

Your Reports in One File.

You can download all your country reports in one file once you connect your exchange/wallet and import transactions through manual input or auto-sync.

Calculate Realized Gains & Losses.

The reports page shows your calculated realized gains and losses for your connected exchanges/wallets.

Secure Auto-Sync.

After connecting your exchanges through an API key, you can enable auto-sync. Therefore, all displayed information will be in real-time.

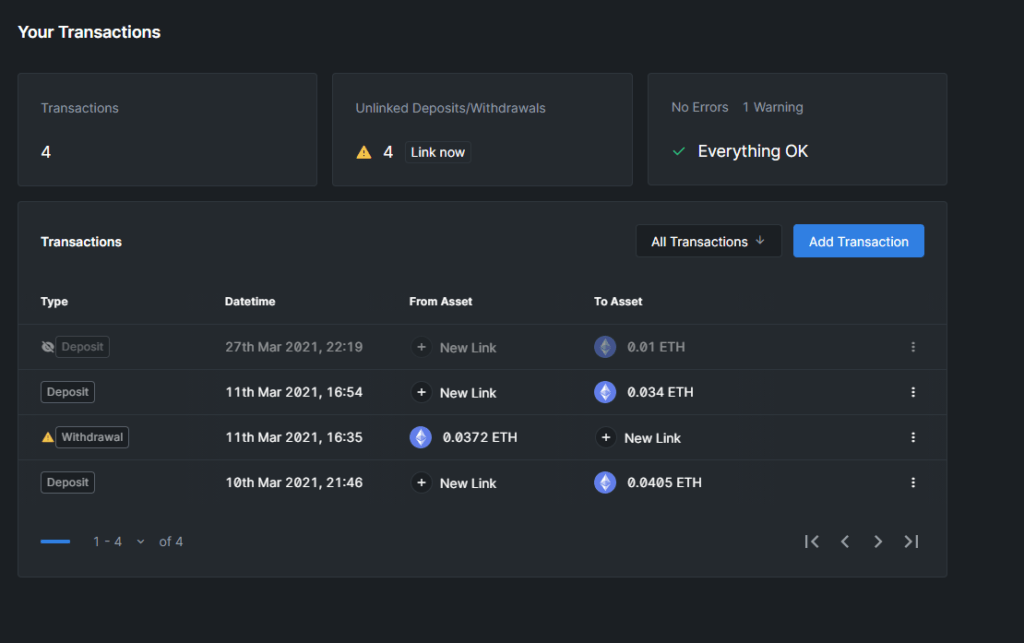

Transactions.

You can view all your previously made transactions and further information on each transaction.

Supported Exchanges.

Blockpit widely supports major exchanges.

FAQ.

Is Blockpit Easy to Use?

During our review, we found Blockpit very easy and simple to use. You only need to connect your exchange, let Blockpit run calculations, and manage to download the tax report.

How Secure is Blockpit?

For exchanges, they’re connected through an API key that doesn’t permit withdrawals. Therefore, your assets will remain on your exchange.

Which Countries Does Blockpit Support?

Blockpit can fill reports for countries that use international accounting methods like LIFO and FIFO. Also, Blockpit localizes reports for some counters.

Which Tax Reports Does Blockpit Support?

Blockpit supports international tax reports as well as some localized ones; here’s a list of the supported reports:

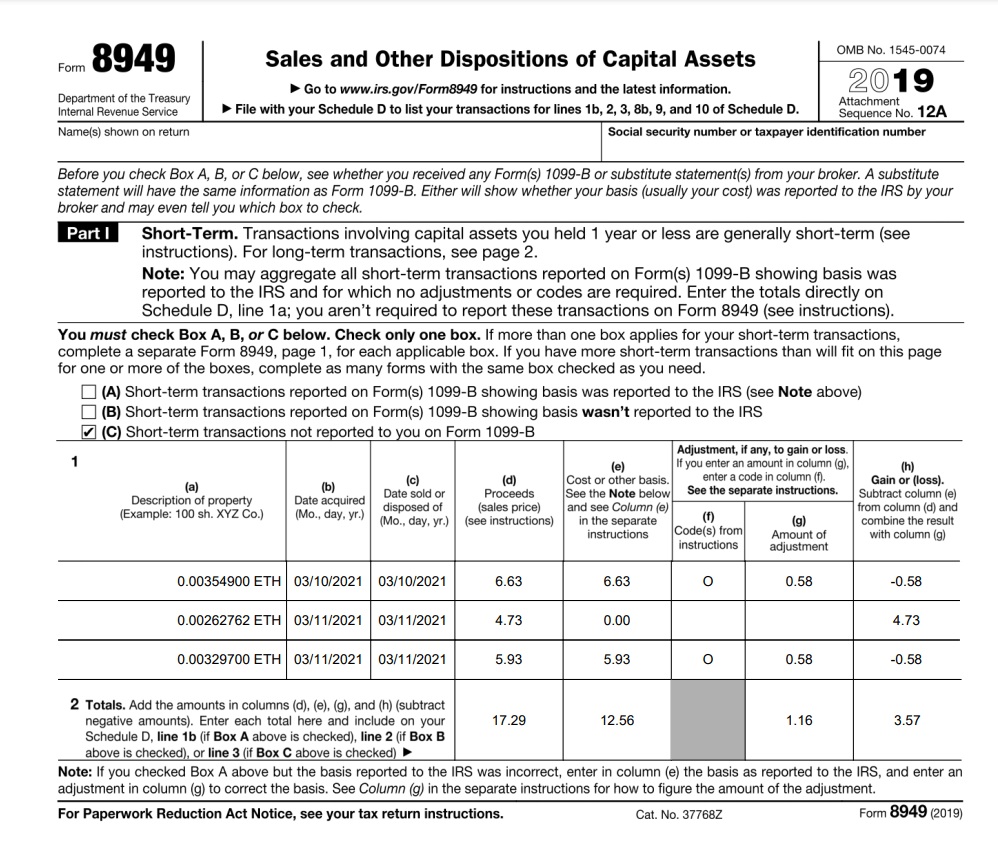

IRS form 8949

Capital gains & losses

Additional income and adjustments to income

Form 1040 U.S individual income tax return

What’s Blockpit Pricing?

Blockpit charges you per tax year. Choose the plan that fits your the most.

Starting with Blockpit.

In the following part of the Blockpit review, we’ll explain how to start on Blockpit, connect your exchange, and calculate your taxes.

Create An Account.

First, go to Blockpit main page, click ‘Get Started,’ enter your information, and then submit it.

Verify Your Account.

After creating your account, go to your email and look for an email from Blockpit’s team for an activation link.

Connect Your Wallet or Exchange.

After creating and verifying your account, now let’s connect your exchange/wallet.

Firstly, on the top bar, click on ‘Depots,’ then select the exchange you’re willing to connect and enter the API key that you’ve generated on your Exchange.

And for wallets, choose the asset held on your wallet, then enter your wallet’s public key.

Generate A Tax Report.

After connecting your exchange, click ‘Reports’ on the top side, then calculate your reports. After that, you can download them as one PDF file.

Conclusion.

There’s no doubt that Blockpit has a lot to offer. But does it compete with other big crypto tax calculators like Koinly or Coinpanda? You can answer that question yourself after reading Blockpit’s pros and cons.

Pros.

- Localized tax reports

- A wide range of supported countries

- simple and interactive UI

Cons.

- It doesn’t integrate with TurboTax.

- It doesn’t support as many exchanges as other platforms.