Crypto Tax Calculator Software

An easy-to-use tool to prepare your taxes in a matter of minutes. Over 500 integrations with support for complex scenarios such as DeFi & NFTs.

Crypto Tax Calculator Review And Best Alternatives

During this article: Crypto Tax Calculator review, we will demonstrate how to calculate your taxes in just a few moments with no hassle.

Cryptocurrency trading can be very profitable, especially if you have enough knowledge; however, all crypto traders, experts, and novices still suffer from calculating taxes and filling reports. At the end of each financial season, you can calculate your taxes and fill out reports; Furthermore, such reports can vary depending on your country; also, accounting methods can change.

Crypto Tax Calculator is a tool that is more than smart enough to calculate your crypto taxes in a few moments. Not only will you get calculations with no human error at all, but you will be able to fill different types of reports with varying accounting methods.

About Crypto Tax Calculator.

Crypto taxes can be painful, but with Crypto Tax Calculator, a simple and easy-to-use tool, you can prepare your taxes in a matter of minutes—over 500 integrations with support for complex scenarios such as DeFi & NFTs.

Also Read: Best Hardware Wallets in 2021.

Crypto Tax Calculator Features.

In the following part of our Crypto Tax Calculator review, we will discuss the tool’s best features explicitly created to improve your experience.

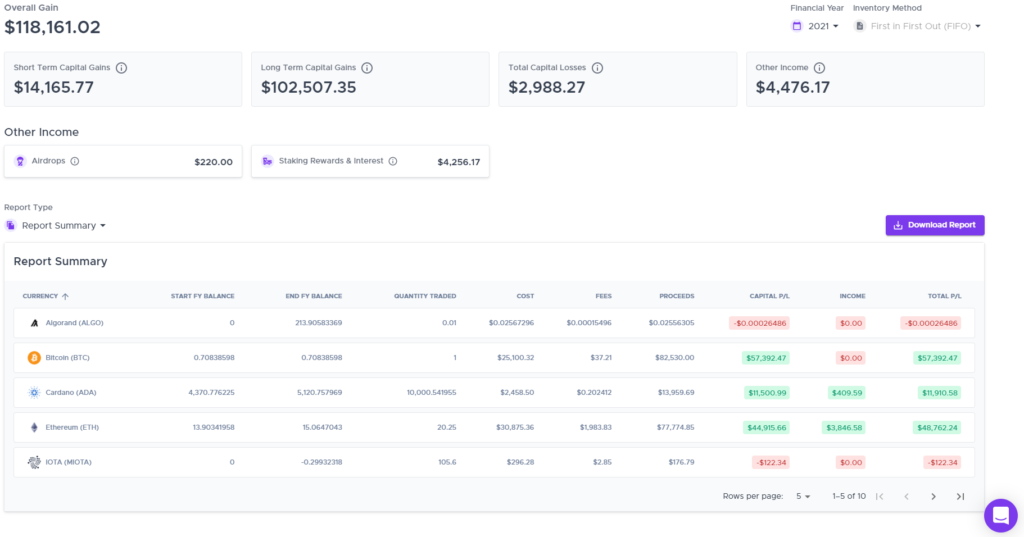

Powerful & Accurate Tax Reports.

The platform performs tax calculations with a high degree of accuracy. We carefully consider complex tax scenarios such as DeFi loans, DEX transactions, gas fees, leveraged trading, and staking rewards.

Easy to Understand Calculations.

Crypto Tax Calculator will provide a full breakdown of each calculation so you can understand exactly how your taxes are calculated and what rules have been applied, with customizable controls to support your unique individual circumstances.

Supports DeFi & DEX Trading.

Their software works with complex DeFi products. If you used a DEX such as Uniswap, Pancakeswap, or SushiSwap, we have you covered. They also support the most popular LP and staking protocols. Just add your public wallet address.

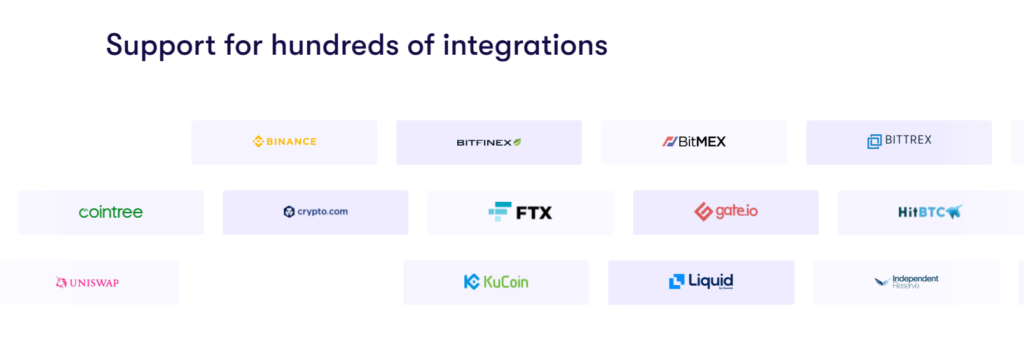

Supported Wallets & Exchanges.

There is no doubt that supporting most wallets and exchanges is essential. Luckily, Crypto Tax Calculator supports +450 exchanges and wallets, including top platforms such as Binance, Binance US, Bitfinex, Trust Wallet, and much more. You can search for your exchange/wallet on this page.

FAQ.

Is Crypto Tax Calculator easy to use?

As a matter of fact, you will get used to Crypto Tax Calculator for the first time of using it. The platform only requires three actions to calculate your taxes which are very simple. We will demonstrate the entire process of using Crypto Tax Calculator in the following part of our Crypto Tax Calculator review.

Which countries does Crypto Tax Calculator support?

Crypto Tax Calculator supports the following countries: Australia, Canada, UK, USA, South Africa, Austria, Belgium, Germany, Spain, Finland, France, Greece, Ireland, Italy, Japan, Netherlands, Norway, New Zealand, Portugal, Sweden, and Singapore.

How is crypto tax calculated?

In the United States, you are required to record the value of the crypto in your local currency at the time of the transaction. Also, this can be highly time-consuming to do by hand since most exchange records do not have a reference price point, and forms between exchanges are not easily compatible.

Which tax reports does Crypto Tax Calculator support?

Crypto Tax Calculator supports the following tax reports:

Capital Gains Report

Income Report

Derivative PnL Report

Trading Stock Report

FIFO, HIFO & Others

Export to CSV & PDF

Form 8949 & 1041 S1

Export to TurboTax

How much does Crypto Tax Calculator cost?

Crypto Tax Calculator has four different plans. Plans start at $49 up to $299; Plans are billed annually, and each plan has limited transactions to process. Crypto Tax Calculator supports the following tax reports:

Getting Started with Crypto Tax Calculator.

Starting with Crypto Tax Calculator is easy, and during the following part of this Crypto Tax Calculator review, we will demonstrate the process.

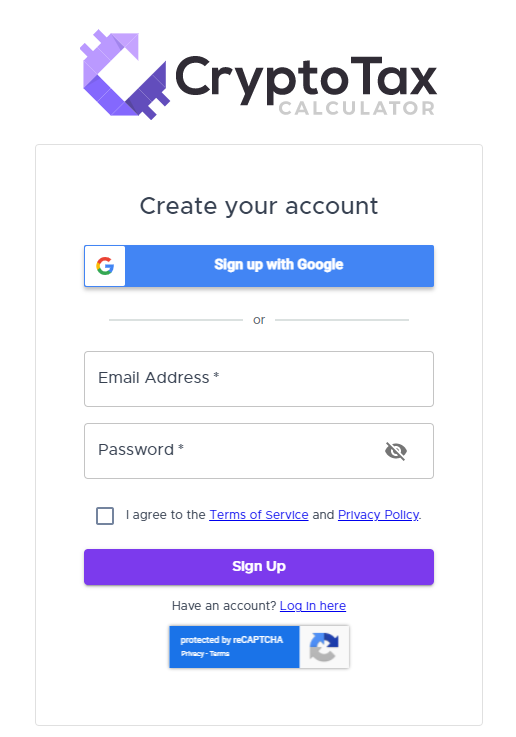

Sign up on Crypto Tax Calculator.

Firstly, head to Crypto Tax Calculator main page and click on “Sign up” on the top right corner.

Verify your account.

After entering your account information, check your email for a verification link sent by Crypto Tax Calculator’s team in order to complete your account registration.

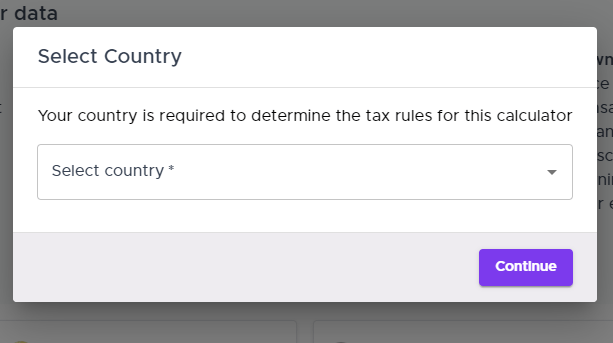

Import your data.

Now that you have created your account successfully, Crypto Tax Calculator will proceed with setting up your account. Firstly, Select your country.

After that, you can start by connecting your exchange to Crypto Tax Calculator.

Connecting to your exchange platform requires an API key and API secret while connecting to your wallet requires entering your wallet’s public key. You can always upload a CSV file of your transaction in both cases.

Generate your tax report.

Conclusion.

During this Crypto Tax Calculator review, we were impressed by many factors; the simplicity and wide range of exchanges/wallets support. The overall experience was excellent; you can generate your tax report using Crypto Tax Calculator in literally less than 2 minutes. You can upload your transactions as a CSV file and export it to TurboTax.

Pros.

- Huge wallets/exchanges support;

- simple and easy to use;

- friendly user-interface.

Cons.

- There is no free plan.