Empowering Blockchain Intelligence

IntoTheBlock provides you with unique insights for every crypto asset to make informed investment decisions. Their 50+ indicators and signals provide a unique view of every crypto asset’s behavior.

IntoTheBlock Review And Best Alternatives

With the increasing popularity of cryptocurrencies in recent years, the need for reliable analytics platforms has become paramount. IntoTheBlock is one such platform, providing users with detailed insights into the cryptocurrency industry. This cryptocurrency analysis platform is renowned for its blockchain intelligence capabilities, offering users a thorough understanding of the underlying technology powering these digital assets.

Through its real-time analytics and market trends analysis, IntoTheBlock empowers users to make informed investment decisions. Its usability and user-friendly features ensure a seamless experience for users, regardless of their level of expertise in the field of cryptocurrency.

Those looking for risk assessment tools and strategies to optimize their cryptocurrency portfolios will find IntoTheBlock to be a valuable resource. Its investment insights and analytics provide users with a solid foundation for developing informed investment strategies.

In this review, we will take a comprehensive look at IntoTheBlock, exploring its features, usability, blockchain intelligence capabilities, and how it can be used for developing investment strategies in the cryptocurrency industry.

Key Takeaways

- IntoTheBlock is a leading cryptocurrency analysis platform known for its blockchain intelligence capabilities.

- The platform offers real-time analytics and market trends analysis for developing informed investment strategies.

- IntoTheBlock is user-friendly and offers risk assessment tools and strategies for optimizing cryptocurrency portfolios.

- The platform’s blockchain intelligence capabilities provide users with a thorough understanding of the underlying technology powering digital assets.

- Investment strategies can be developed using IntoTheBlock’s insights and analytics.

Crypto Analytics Prowess

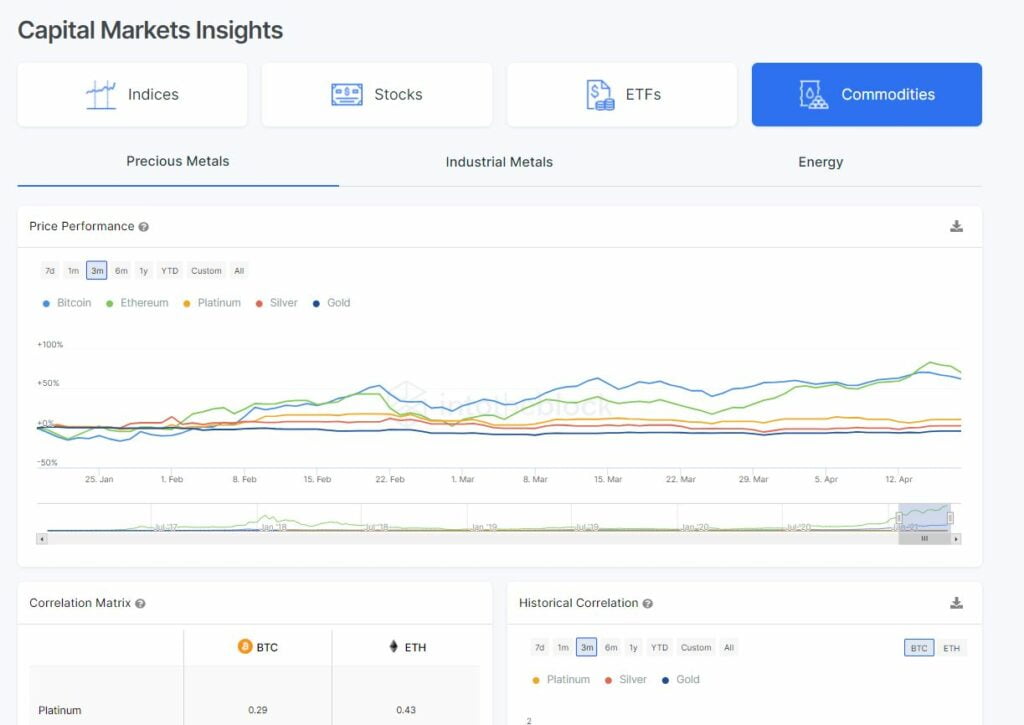

IntoTheBlock’s data-driven insights, real-time analytics, and market trends analysis make it a top contender in the realm of cryptocurrency analysis platforms. Its advanced analytics tools provide users with up-to-date information on market trends, enabling them to make informed decisions regarding their investments.

Data-Driven Insights

IntoTheBlock’s data-driven insights are powered by machine learning algorithms that analyze vast amounts of blockchain data in real-time. This provides users with a comprehensive view of the cryptocurrency market, allowing them to stay ahead of the competition.

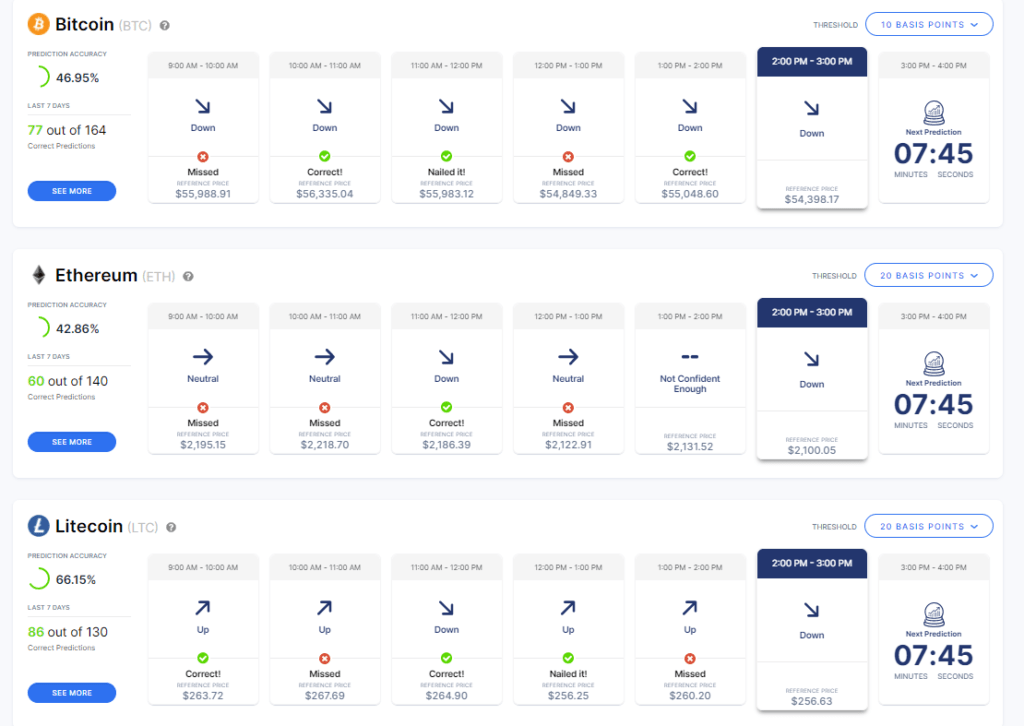

Real-Time Analytics

One of IntoTheBlock’s standout features is its real-time analytics capabilities. Users can access real-time data on a multitude of metrics such as price, volume, and social media sentiment. This allows for quick and informed decision-making, especially in the fast-paced world of cryptocurrency.

Market Trends Analysis

Another impressive feature of IntoTheBlock is its ability to analyze market trends. The platform’s algorithms provide users with insight into where the market is headed, which can be invaluable when it comes to making investment decisions.

Overall, IntoTheBlock’s analytics prowess sets it apart from other cryptocurrency analysis platforms. Its data-driven insights, real-time analytics, and market trends analysis make it an essential tool for investors looking to stay ahead of the game in the volatile world of cryptocurrency.

Usability of IntoTheBlock

IntoTheBlock is a highly usable platform, designed to cater to the needs and requirements of cryptocurrency enthusiasts, beginners, and professional traders alike. Its user-friendly features make it easy to navigate, explore and analyze data-driven insights, helping users make informed decisions.

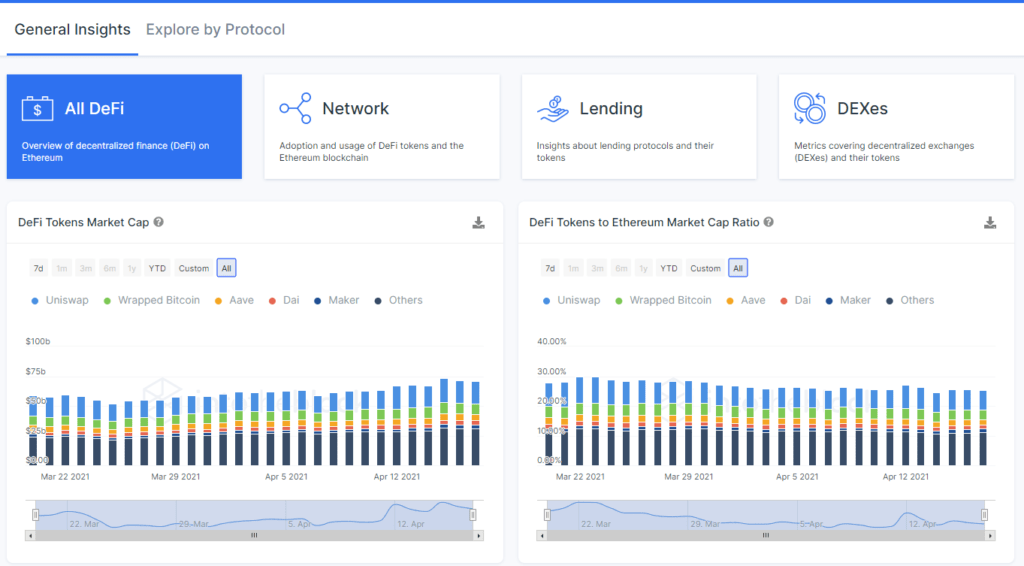

Dashboard

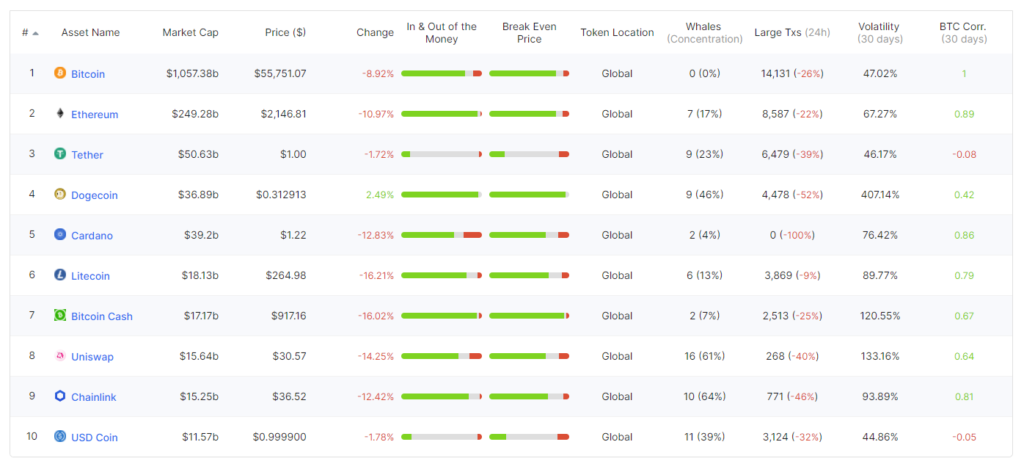

The platform has a well-organized dashboard that provides users with real-time analytics and a bird’s eye view of the cryptocurrency market. Its layout is intuitive and effortless to use, with all the necessary information at the user’s fingertips. The dashboard displays detailed graphs and tables, showcasing the latest market trends, price movements, and activity. This feature ensures that users stay informed about the current state of the cryptocurrency market at all times.

Filters

IntoTheBlock’s usability is further enhanced by its filtering options. Users can use various filters such as market cap, trading volume, and daily price change to narrow down their search and focus on specific cryptocurrencies. This feature reduces clutter, allowing users to obtain data-driven insights into cryptocurrencies that matter the most to them.

Customizable Alerts

One of the standout features of IntoTheBlock is its customizable alerts, which enable users to set notifications for significant price changes, market movements or events in the cryptocurrency market. This feature empowers users to stay informed, even when they’re away from their desks, ensuring they never miss out on a potential investment opportunity.

Real-time Data Analysis

IntoTheBlock’s usability is heightened by its ability to provide real-time data analysis without any significant lag. The platform has a high processing power, allowing users to access accurate data insights that aid them in making informed decisions. Its market-leading capabilities ensure that users stay ahead of the curve and informed about market trends in real-time.

Blockchain Intelligence

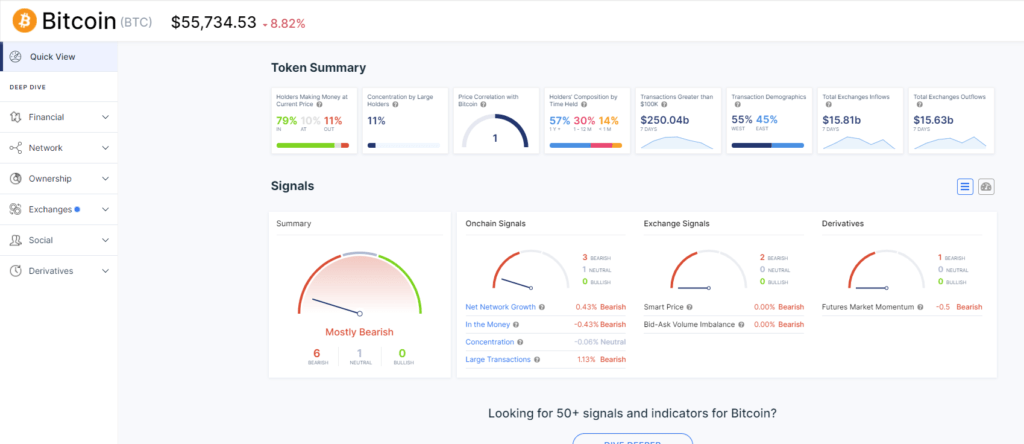

One of the most significant aspects of IntoTheBlock is its blockchain intelligence feature, which provides users with in-depth crypto investment research capabilities. By leveraging advanced machine learning and natural language processing techniques, the platform analyzes vast amounts of blockchain data to extract valuable insights into market trends and investment opportunities.

IntoTheBlock’s blockchain intelligence tools enable users to gain a deeper understanding of the cryptocurrency market, identify emerging trends, and make informed investment decisions. The platform’s sophisticated algorithms analyze blockchain data in real-time, providing users with a comprehensive view of the market and helping them to stay ahead of the competition.

Moreover, IntoTheBlock provides users with access to a range of analytics and visualization tools, which can be used to identify investment opportunities and develop effective investment strategies. Whether you’re a seasoned investor or just starting, IntoTheBlock’s blockchain intelligence capabilities can help you make informed, data-driven decisions and maximize your returns on investment.

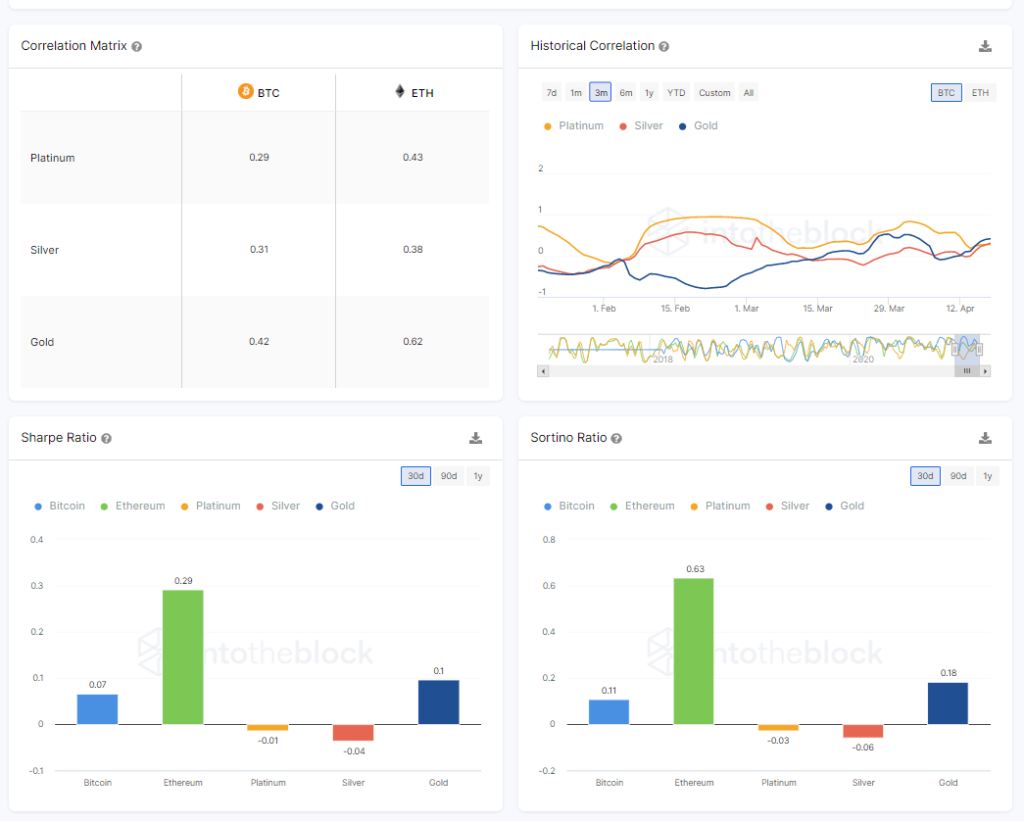

Portfolio Optimization and Risk Assessment

One of the primary benefits of using IntoTheBlock is the ability to optimize your cryptocurrency portfolio. The platform offers a range of risk assessment tools that help you analyze your investments and make informed decisions.

Portfolio Optimization

Through IntoTheBlock’s data-driven insights, you can identify which cryptocurrencies have high potential and which ones may be risky. This information can be used to optimize your portfolio and maximize its potential returns. The platform also provides recommendations on the ideal portfolio allocation based on your risk tolerance and investment goals.

Risk Assessment

IntoTheBlock’s risk assessment tools allow you to evaluate the risk associated with each cryptocurrency in your portfolio. The platform provides a risk score based on several factors, including volatility, liquidity, and market sentiment. By understanding the risk associated with each investment, you can make informed decisions about your portfolio and minimize potential losses.

| Cryptocurrency | Risk Score | Volatility | Liquidity | Market Sentiment |

|---|---|---|---|---|

| Bitcoin | 7.5 | High | High | Bullish |

| Ethereum | 8.2 | High | High | Bearish |

| Ripple | 5.9 | Low | High | Neutral |

The table above showcases how IntoTheBlock analyzes the risk associated with Bitcoin, Ethereum, and Ripple, based on their volatility, liquidity, and market sentiment. This information can be used to make informed decisions about your cryptocurrency portfolio, ensuring that you are minimizing risk while maximizing potential returns.

- IntoTheBlock’s data-driven insights allow for portfolio optimization.

- The platform provides risk assessment tools to evaluate the risk associated with each cryptocurrency.

- By analyzing the risk and potential returns, you can make informed decisions about your portfolio.

Investment Strategies with IntoTheBlock

IntoTheBlock provides a range of insights and analytics that can help users make informed decisions while investing in cryptocurrencies. Here, we will explore some of the investment strategies that can be developed using this platform.

1. HODLing

The most straightforward and widely practiced investment strategy in the cryptocurrency industry is HODLing. It involves buying a cryptocurrency and holding onto it for a long time, regardless of its market performance. IntoTheBlock can aid HODLers by providing insights into the fundamental factors of a cryptocurrency, such as its development activities, adoption rate, and network growth.

2. Swing Trading

Swing trading is a strategy that involves buying and holding a cryptocurrency for a short period, typically a few days to a few weeks. It aims to capitalize on short-term price movements. IntoTheBlock can assist swing traders by providing real-time analytics and data-driven insights that enable them to identify potential market trends and capitalize on them.

3. Day Trading

Day trading is a more aggressive investment strategy that involves buying and selling a cryptocurrency within the same trading day. It relies heavily on real-time analytics and market trends analysis. IntoTheBlock can assist day traders by providing real-time data and insights, as well as fundamental analysis of the cryptocurrency market.

4. Portfolio Diversification

Portfolio diversification is a strategy that aims to minimize risk by investing in a variety of cryptocurrencies. IntoTheBlock can aid portfolio diversification by providing risk assessment tools and strategies that enable users to balance their investments and minimize potential losses.

5. Trend Following

Trend following is a strategy that involves identifying and following market trends. IntoTheBlock can assist trend followers by providing real-time analytics and data-driven insights that enable them to identify potential market trends and capitalize on them.

Overall, IntoTheBlock provides a range of insights and analytics that enable users to develop effective investment strategies and make informed decisions while investing in cryptocurrencies.

Conclusion

After conducting a comprehensive review of IntoTheBlock, it is evident that the platform offers unparalleled insights and analytics for those interested in the cryptocurrency industry. Its user-friendly features and real-time analytics capabilities allow users to stay up-to-date with market trends, while its blockchain intelligence tools aid in conducting thorough crypto investment research.

Furthermore, IntoTheBlock’s risk assessment strategies and portfolio optimization tools provide a unique advantage to cryptocurrency traders and investors, enabling them to make informed and calculated decisions. Overall, the platform’s investment strategies and analytics prowess make it a valuable asset to anyone looking to succeed in the world of cryptocurrency.

In conclusion, for those seeking an in-depth and data-driven approach to cryptocurrency analysis, IntoTheBlock is an excellent choice. Its diverse range of features and capabilities make it an ideal platform for both novice and experienced traders alike.

FAQ

What is IntoTheBlock?

IntoTheBlock is a leading cryptocurrency analysis platform known for its blockchain intelligence capabilities.

What insights does IntoTheBlock provide?

IntoTheBlock offers data-driven insights and real-time analytics to help users analyze market trends in the cryptocurrency industry.

Is IntoTheBlock user-friendly?

Yes, IntoTheBlock is designed with usability in mind, offering user-friendly features that enhance the overall experience of using the platform.

What is the significance of blockchain intelligence?

Blockchain intelligence is essential for conducting thorough crypto investment research, and IntoTheBlock specializes in providing this intelligence.

How does IntoTheBlock help with portfolio optimization and risk assessment?

IntoTheBlock aids users in optimizing their cryptocurrency portfolios by providing risk assessment tools and strategies.

Can IntoTheBlock help with investment strategies?

Yes, IntoTheBlock’s insights and analytics can be used to develop various investment strategies, helping users make informed decisions.

What are the key takeaways from the IntoTheBlock review?

The IntoTheBlock review highlights the platform’s features, usability, and blockchain intelligence capabilities, providing valuable insights for crypto investors.