CoinTracking and Koinly Comparison. Review And Best Alternatives

CoinTracking and Koinly Comparison.

In today’s article: CoinTracking and Koinly Comparison, we will compare two of the most powerful tax calculators and highlight their features.

At the end of each financial season, you have to calculate your taxes. In fact, it’s a systematic process but it can consume a lot of your time and money. Furthermore, if such processes if done by humans, there is a huge chance to have human errors that might lead to fatal mistakes.

CoinTracking and Koinly are both great software assisting you to calculate your taxes in a couple of minutes with no hassle; no time wasting, no mistakes, and much more to discover through this article.

Also Read: 15 Best Crypto Tax Softwares & Calculators in 2022.

Features.

In the following part of our CoinTracking and Koinly comparison, we will compare both software features in order to give you a comprehensive idea.

1. CoinTracking.

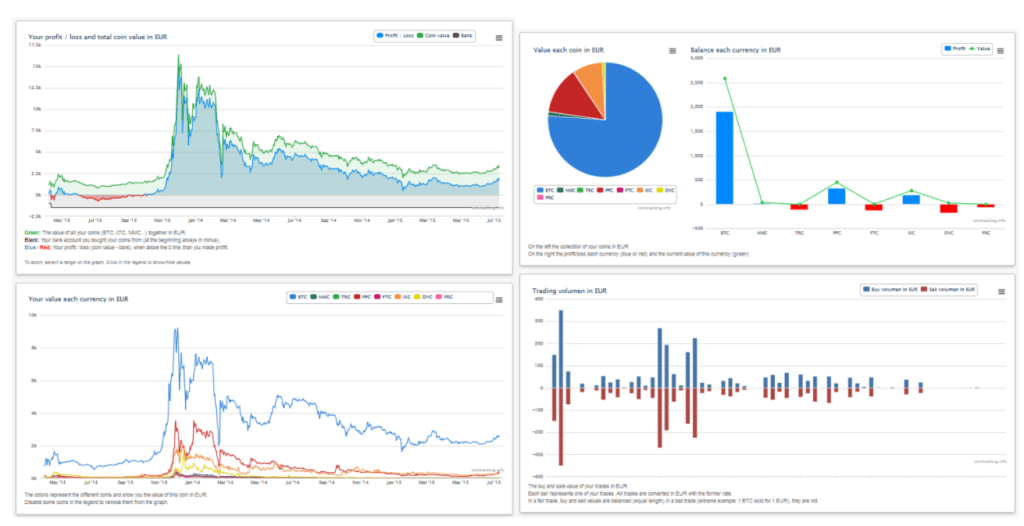

- Personal Analysis: You can fill over 25 customizable crypto reports. CoinTracking can also fill profit/loss & audit reports and calculate realized and unrealized gains You will also get live charts for all your trades and coins, which really helps to understand how your performance was during the year. You’ll get the following statistics.

- Trade Imports: CoinTracking integrates with over 110 exchanges that you can choose to either automatic sync or upload your transactions via different file types like CSV.

- Live Charts: CoinTracking also has a price list of over 9000 digital currencies available on the market, including price trends, market cap, and the current trading volume.

2. Koinly.

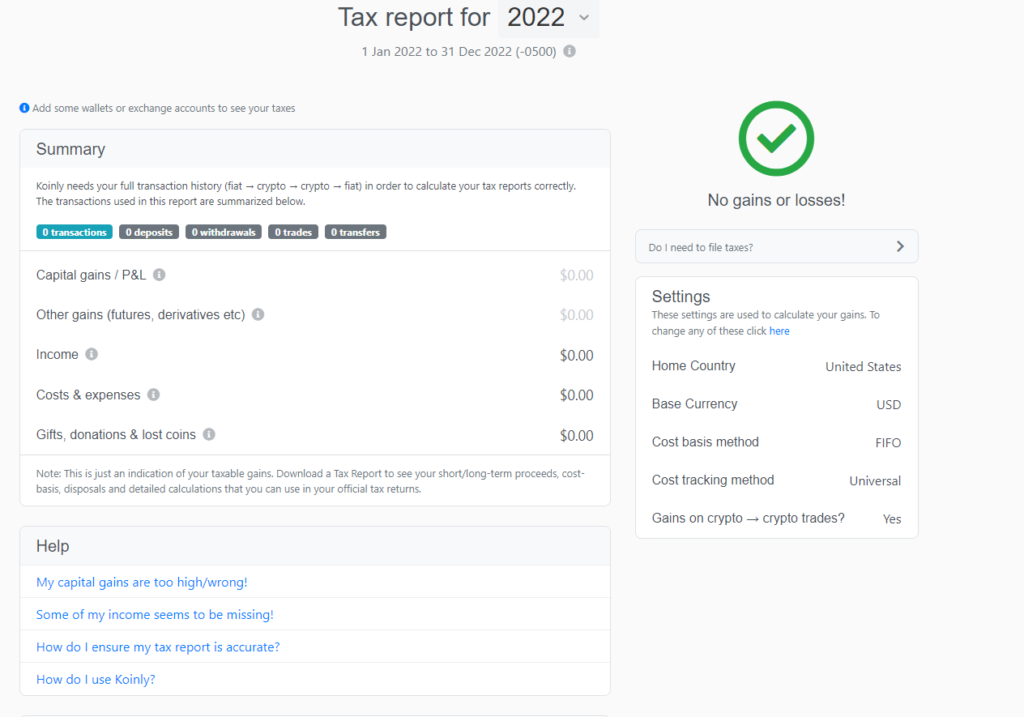

- Portfolio Tracking: You’ll easily know all about your holdings in all your wallets, Actual ROI and invested fiat, Income overview, and Profit/loss & capital gains.

- Data Import: Safely import data from your wallets into Koinly. That way no need to keep moving back and forth from one wallet to another. Sync your wallet’s data to Koinly to get a full view of your wallets and all your trading activity with the help of many

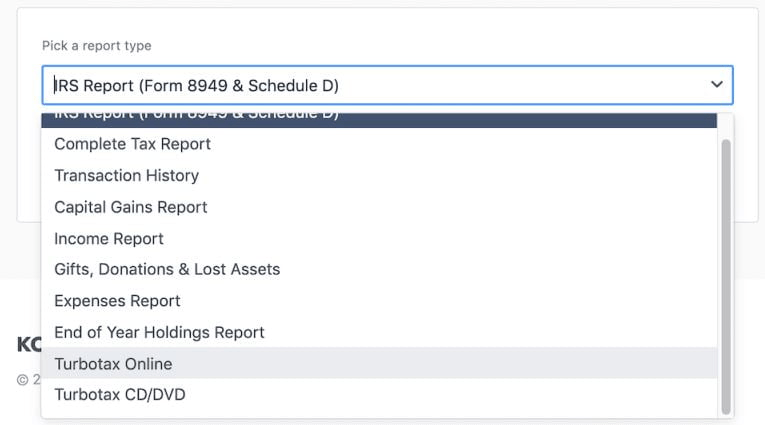

- Reliable Tax Reports: You can view your capital gains and taxes and generate documents when you want. In addition, you can export your transactions to other tax software like TurboTax, TaxAct, and H&R.

- Error Reconciliation: No more inaccurate tax reports! With many tools that Koinly offers you to find any problem with your transactions such as a Double-entry ledger system, Missing transactions, Auto import verification, and Duplicate handling.

2. Supported Exchanges and Cryptocurrencies.

| CoinTracking | Koinly | |

| Supported Exchanges and Cryptocurrencies. | CoinTracking supports over 110 exchanges including top exchanges such as Binance, KuCoin, BitMEX, and more. It also supports all the coins listed on any of the supported exchanges. You can view the full list on CoinTracking website. | With Koinly, you will get to a generous number of exchanges. Koinly supports over 350 crypto exchanges including all the coins supported by these exchanges. Check the full list on Koinly website. |

3. Supported Countries.

| CoinTracking | Koinly | |

| Supported Countries. | CoinTracking has Full support for the US, India, UK, Canada, and Australia and partial support for others. | Koinly supports the following countries. USA, Canada, Australia, New Zealand UK, Germany, Sweden, Denmark, Finland, Norway, Netherlands, France, Spain, Italy, Austria, Lichtenstein, Ireland, Czech Republic, Estonia, Malta Japan, South Korea, Singapore |

4. Supported Reports.

| CoinTracking | Koinly | |

| Supported Reports. | Form 8949 and Schedule D. Capital gains summary for the UK. K4. Rf1159 Capital Gains Report Income Report Gift and Donation Report Fee Report Lost and Stolen Report Closing Position Report | Form 8949 and Schedule D. Capital gains summary for the UK. K4. Rf1159. Swiss Valuation Report. Sheet 9A. Complete Tax Reports. Transaction Reports. Capital Gains Reports. Income Report. Gifts, Donations & Lost Asset Reports. Expense Reports. End of Year Holdings Reports. Turbotax Reports. |

5. Pricing.

| CoinTracking | Koinly | |

| Plans Pricing | CoinTracking has a free plan. But also, to remove all the limits on the free plans, you can upgrade to paid plans starting at $10.99~$54.99 here. More details | You can check Koinly. Starting at $49, $99, $179 ($279) for Newbie, hodler, teader(pro) with a free plan. |

6. Pros and Cons.

| CoinTracking | Koinly | |

| Pros | 1. Customizable reports 2. Many accounting methods supported 3. Supports over 100 countries 4. Wide list of tax reports. | 1. Very easy and simple to use. 2. A lot of supported tax reports. 3. Localized tax reports for your country. 4. You can pay with crypto. |

| Cons | 1. Doesn’t work with TurboTax 2. Hard to use at the first glance. | Haven’t found any. |

Eventually, it is crucial for all traders to have a crypto tax calculator with them. Instead of spending lots of your time calculating your taxes, tax software can do it in a few clicks.

CoinTracking and Koinly are both great software that we highly recommend; if you are looking for further details you can check out our detailed reviews on CoinTracking and Koinly in order to get a comprehensive idea.

In general, CoinTracking and Koinly are very similar. Still, there are a few things that might favor Koinly over CoinTracking such as the support of more exchanges and integration with tax software TurboTax. On the other hand, CoinTracking is much cheaper than Koinly; it’s pretty hard to make a decision.

It cheers us to read your comments. Make sure to comment your thoughts in the comments section below and we will reply to you as soon as we can.