Crypto Taxes Done in Minutes

One of the most accurate and reliable DIY tax prep software for crypto investors. With over 12 billion dollars in transaction volume and partnerships with leading consumer tax software platforms.

CoinLedger Review And Best Alternatives

If you trade with crypto, you need to pay taxes at the end of each year. Besides that, it comes with a lot of work. That’s where tax calculators come to play.

In this Coinledger review, we’ll bring all about Coinledger and how you can save time using it.

About Coinledger.

It’s software to calculate your taxes with the support of many tax reports. Besides, you’ll be able to easily and quickly calculate exactly what you have to pay. Plus, we’ll pilot you through all of the Coinledger features.

Coinledger Features.

Coming with a generous amount of features. Coinledger has unique and helpful tools to assist you in calculating your taxes.

Never Overpay On Your Taxes.

When using Coinledger, Know for sure that you are paying the correct amount of taxes. Besides that, they use the same methods specialists use to reduce your crypto tax liability.

Export Your Tax Report & File With Ease.

After generating your tax report, you can download your completed IRS file so you can send it to your accountant or import it into other software like TurboTax and TaxAct.

Trusted TurboTax Partner.

Speaking of tax software, Coinledger partnered with the largest tax preparation platform, TurboTax. Therefore you can effortlessly send your reports directly to TurboTax.

International Tax Support.

Coinledger can calculate your gains and losses using every fiat currency. You can use your report for any country that supports FIFO, LIFO, or specific identification calculation methods.

Tax Loss Harvesting.

In addition to planning your future trades! With tax-loss harvesting built-in tools. You can balance and reduce your capital gains. Besides that, cryptocurrencies with the largest tax savings shots appear on the tax-loss harvesting report.

Supported Crypto and Exchanges.

In addition to the big list of features, Coinledger supports over 40 major exchanges and wallets.

Also, Coinledger supports every crypto listed in the supported exchanges. Even if an exchange removed your cryptocurrency from your exchange, Coinledger would still have the historical information to calculate your taxes.

FAQ.

Is Coinledger Easy to Use?

Yes, Coinledger is very easy and simple. Even if you’re a newbie, you can get all the information you need due to their simple interface and instructions.

How Secure Is Coinledger?

Very much secured. You connect to your exchange through an API key, which is undoubtedly secure. Also, for wallets, you upload your transaction history—no required passwords or emails.

What Are The Supported Tax Reports? Are They Localized?

No, they’re not localized. However, Coinledger supports all of the international tax reports and popular ones too! And here’s a list.

FIFO Support, LIFO Support, HIFO Support

Cryptocurrency Income Report.Short & Long-Term Sales Report. IRS Form 8949. Audit Trail Report, End-of-Year Positions Report, TurboTax Direct Import, TaxAct Direct Import

How Much Does Coinledger Cost?

Starting at $49~$299, Coinledger charges you per tax season. You need to pay for the number of transactions you made in the year.

For example, if you made 100 or fewer transactions, ‘Hobbyist’ will fit you.

But if you made 100~1,500, you must subscribe to the Daily Trader plan.

Get Started on Coinledger.

Besides simplicity in using- more on that later, It’s straightforward to start your account and connect your exchange. And We’ll explain that, too, in our Coinledger review.

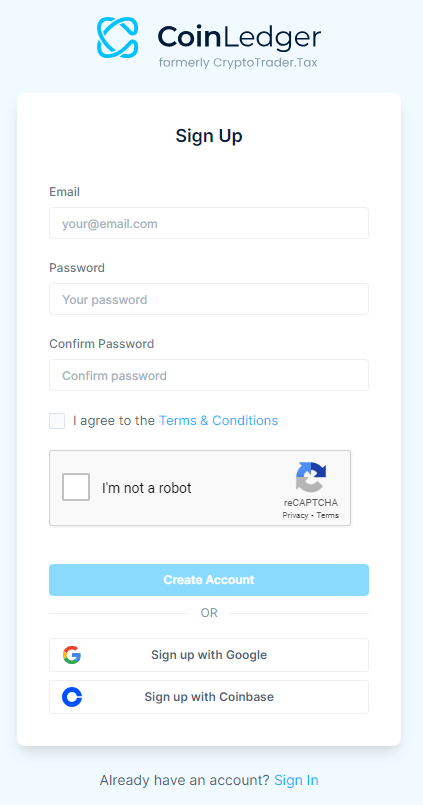

Create an Account.

Firstly, go to Coinledger Sign-up page and enter your information. However, they don’t support signing up using Facebook or Google.

Verify Your Email.

Easily go to your email. Then click on the link they sent you to verify your account.

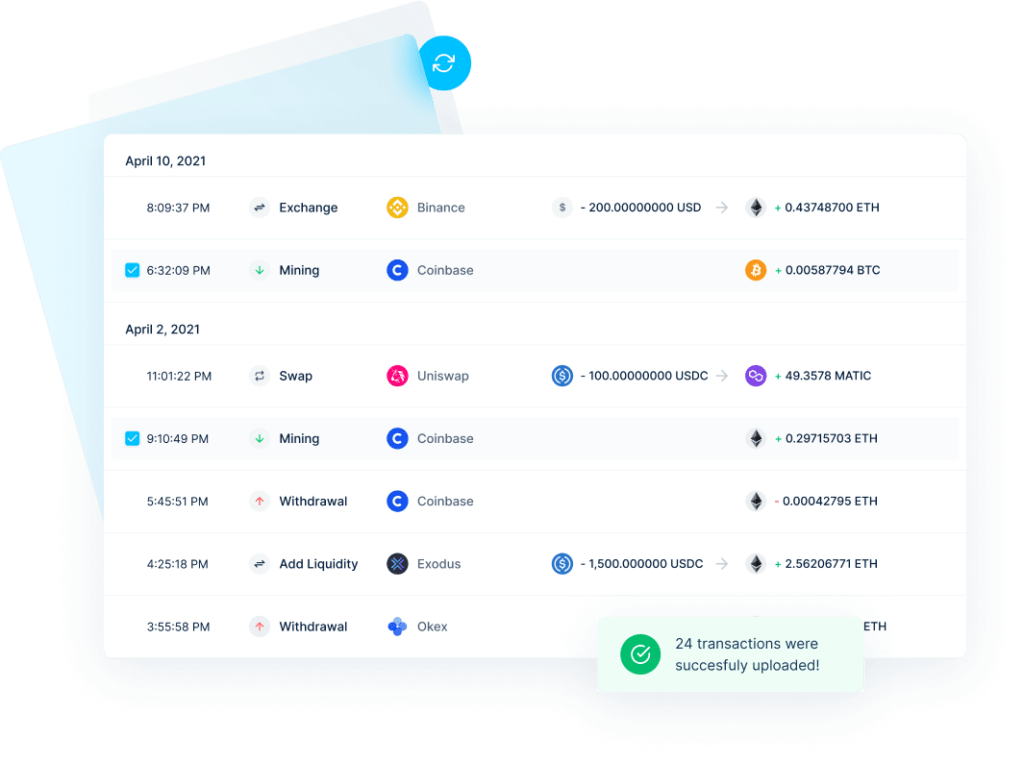

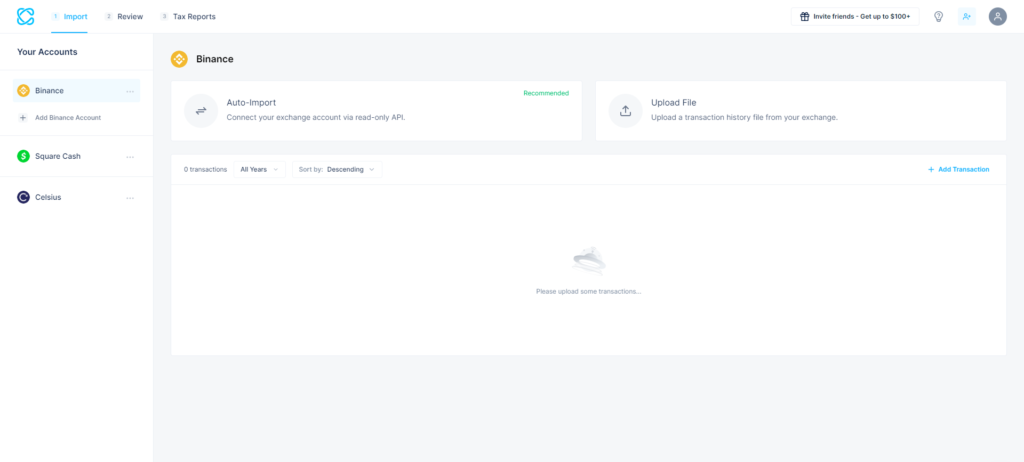

Connect Your Exchange And Import Data.

After creating your account, the First thing that comes to mind is connecting your exchange or wallet.

Firstly, go to your dashboard to overview your Coinledger account. Click ‘Add Account,’ then choose the exchange/wallet you want to connect with. Exchanges are connected through API keys. Also, you can upload a file of your transactions. However, your only option for wallets is uploading a file of your transactions.

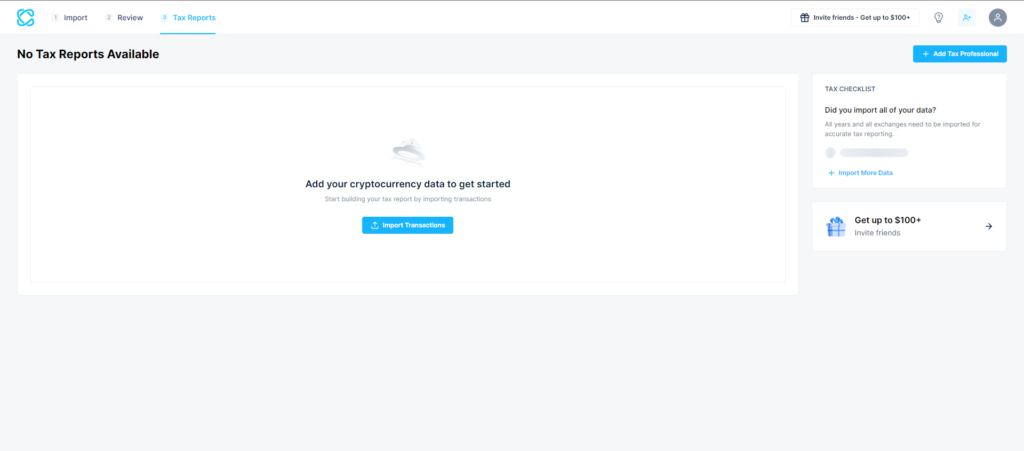

Generate a Tax Report.

For furthermore ease of use, Coinledger will take you to step by step to generate your tax report with instructions and tips!

Conclusion.

To sum up, Coinledger comes with lots of features. However, there are cons too. Here’s a list of what we think of Coinledger listed as pros&cons.

Pros.

- Integrates with all the major exchanges.

- Generates your tax report in minutes.

- Easy to sign up.

- Responsive, user-friendly UI.

Cons.

- No localized tax reports.

- Wallets can’t connect through addresses.